|

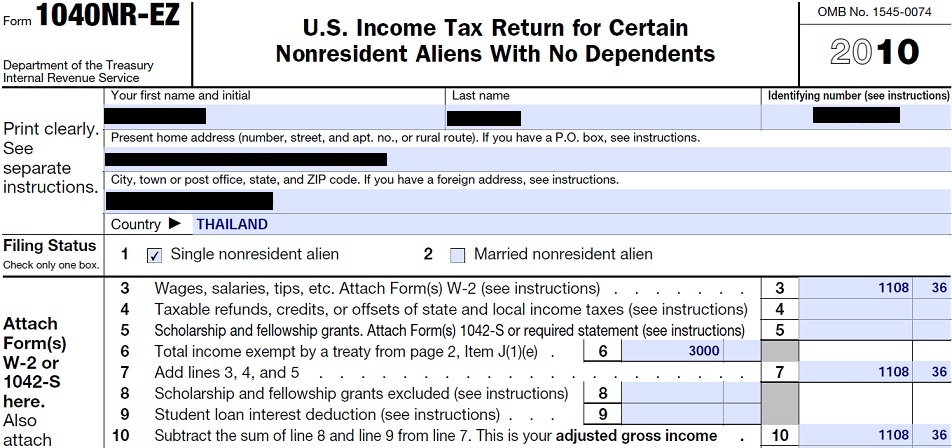

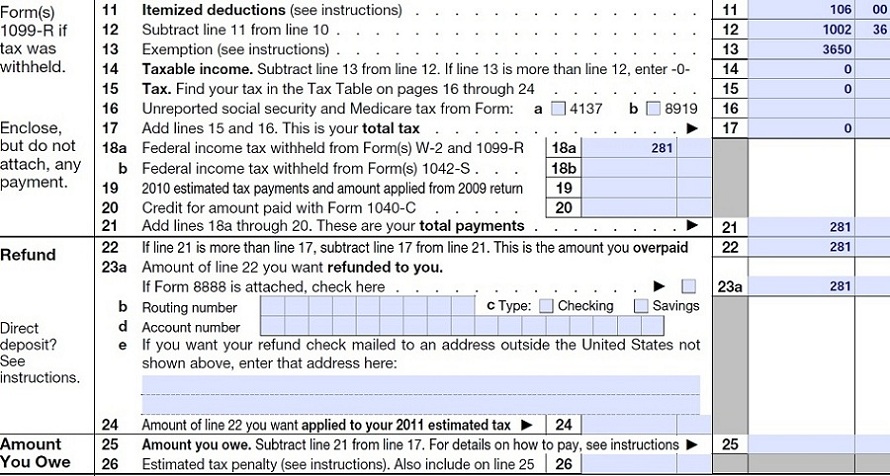

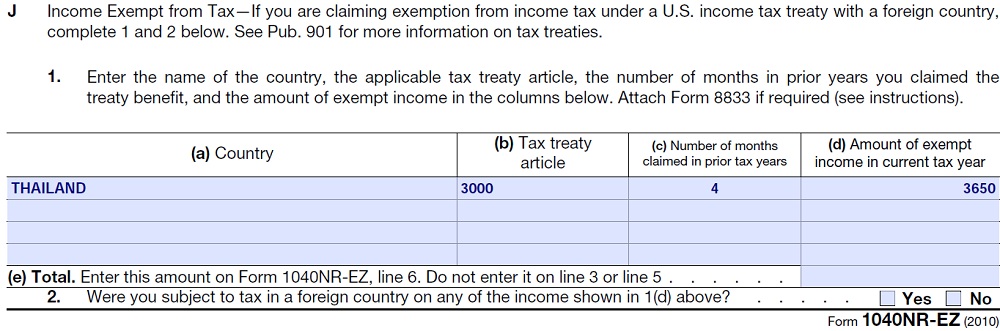

เพิ่มเติม จากตัวอย่าง

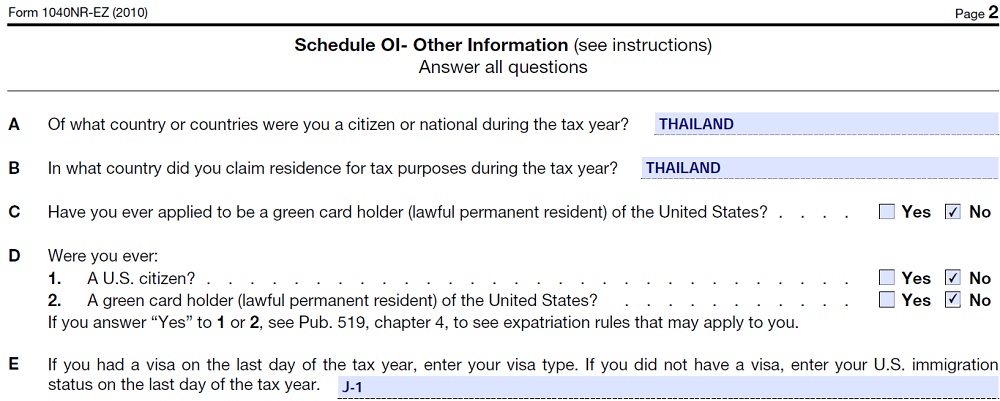

ช่อง J1 B ควรกรอก 22(1)

ช่อง J1 D ควรจะเป็น 3000 ไม่น่าจะเป็น 3650

ช่อง J1 E 3000

J2 ตอบ No ครับ

อ้างอิงจาก

http://www.irs.gov/instructions/i1040nre/ch02.html#d0e2096

http://www.usvisa4thai.com/board/viewtopic.php?f=6&t=29259&start=15

Item J

Line 1. If you are a resident of a treaty country (that is, you qualify as a resident of that country within the meaning of the tax treaty between the United States and that country), you must know the terms of the tax treaty between the United States and that country to properly complete item J. You can download the complete text of most U.S. tax treaties at . Technical explanations for many of those treaties are also available at that site. Also, see Pub. 901 for a quick reference guide to the provisions of U.S. tax treaties.

If you are claiming exemption from income tax under a U.S. income tax treaty with a foreign country on Form 1040NR-EZ, you must provide all the information requested in item J.

Column (a), Country.

Enter the treaty country that qualifies you for treaty benefits.

Column (b), Tax treaty article.

Enter the number of the treaty article that exempts the income from U.S. tax.

Column (c), Number of months claimed in prior tax years.

Enter the number of months in prior tax years for which you claimed an exemption from U.S. tax based on the specified treaty article.

Column (d), Amount of exempt income in current tax year.

Enter the amount of income in the current tax year that is exempt from U.S. tax based on the specified treaty article.

Line (e), Total.

Add the amounts in column (d). Enter the total on line 1e and on page 1, line 6. Do not include this amount in the amounts entered on Form 1040NR-EZ, page 1, line 3 or 5.

If required, attach Form 8833. See Treaty-based return position disclosure below.

Line 2. Check Yes if you were subject to tax in a foreign country on any of the income reported on line 1, column (d).

| จากคุณ |

:

dodocool

|

| เขียนเมื่อ |

:

17 ก.พ. 54 08:26:07

|

|

|

|

|