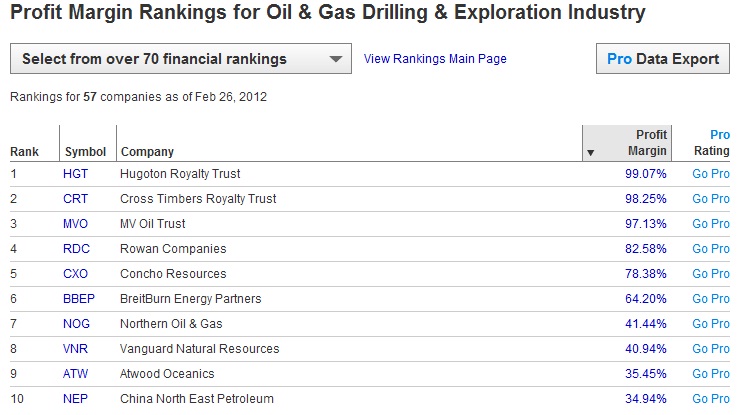

ถ้าคุณหัดหาข้อมูล คุณคงเห็นว่า Margin ของ Industry นี้ก็สูงได้ถึงระดับ 80-90% Margin ด้วยซ้ำ แต่ทำไมถึงไม่ใช่ที่ทุกคนจะโดดเข้ามาทำได้ ก็ไปอ่าน Porters Five Forces ใหม่ซะ

Porters Five Forces

1. Threat of New Entrants

The threat of new entrants is low because barriers to entry include high capital cost, economies of scale, distribution channels, proprietary technology, environmental regulation, geopolitical factors, and high levels of industry expertise needed to be competitive in the areas of exploration and extraction. In addition, fixed cost levels are high for upstream, downstream, and chemical products. Thus, it is very hard for new players to enter the market.

2. Business Rivalry

Business rivalry (i.e., competition) is high because of the commodity-based nature of the business. In addition, there is competition with other industries that supply chemical, energy, and fuel for both industrial and individual consumers. The industry growth rate (based on the global demand for petroleum) is estimated to be 1.9% in 2008 and does not pose a threat or an opportunity. Further, since the oil industry is a commodities market, the competitive advantage is primarily derived from the ability to produce products at a lower cost via operational efficiencies. The significant number of competitors include ExxonMobil, BP, Chevron, Conoco Philips, and Royal Dutch Shell.

3. Supplier Power

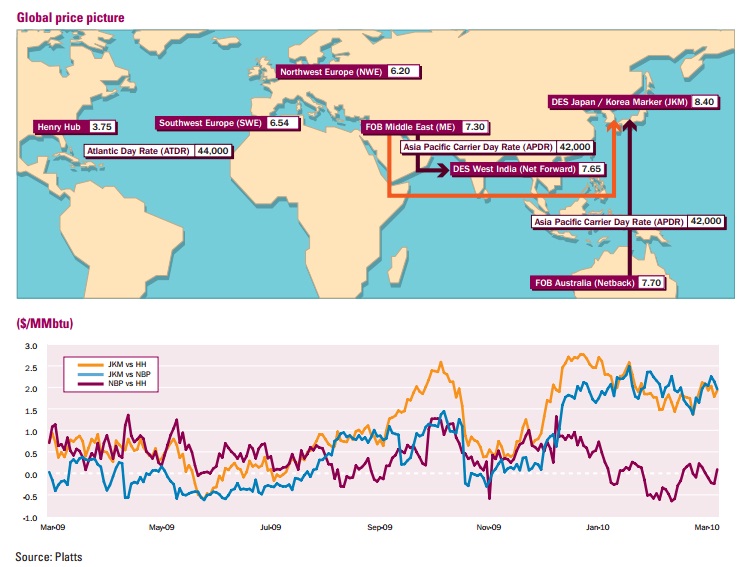

The suppliers are the oil mining and extraction firms (includes Exxon). Supplier power is high because OPEC controls 40% of worlds supply of oil and, thus, has a strong influence on the price of oil. OPECs influence on oil prices is a threat because Exxon purchases oil on the open market. In addition, unstable countries that host Exxon oil reserves are a threat because they can seize Exxons assets at any time. For example, Venezuela recently seized one of Exxons major projects.

4. Buyer Power

Buyers are both industrial consumers and individual consumers. Industrial (i.e., downstream) buyer power is low because upstream suppliers have an incentive to limit supply and keep prices high as is evidenced by the shrinking downstream margins. Individual buyer power is low because of the high volume of demand as is evidenced by the fact that energy prices are continuing to rise despite slowing economic growth worldwide. Further, oil demand is expected to increase in 2008, although not as much as originally predicted.

5. Threat of Substitutes

The threat of substitutes is low and comes from nuclear power, hydroelectric, biomass, geothermal, solar, photovoltaic, and wind. Nuclear and hydroelectric energy sources are not a threat within the next decade because of government regulation, environmental concerns, and a high barrier to entry. Further, photovoltaic sources are limited by technological issues and geothermal sources are limited by geographic availability. The only potential threat could be biomass. However, efficiency levels of biomass have yet to be proven competitive to oil/natural gas. Finally, coal could prove to be a threat to oil consumption as an energy source should technological advancements in coal liquefaction techniques advance to a level that would provide clean, stable oil molecules from the largely abundant domestic coal reserves.

Attractiveness of the Industry: Why are Oil Companies so Profitable?

The Mining/Crude-Oil industry, Petroleum Refining, and Chemicals industries as a group are very attractive because the threat of new entrants is low, buyer power is low, supplier power is high (which is good because most of the big industry players are both suppliers and buyers), and the threat of substitutes is low. The attractiveness of the industry is reduced because business rivalry is high.

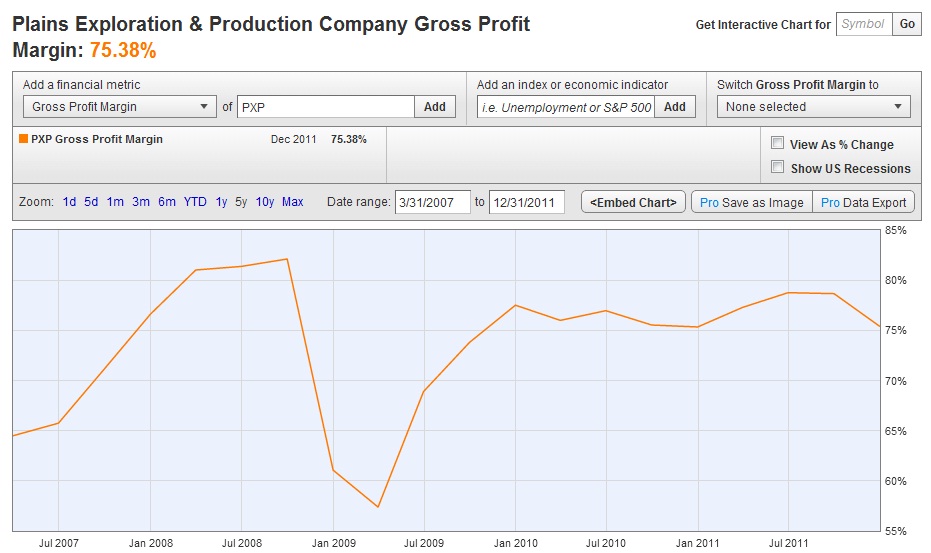

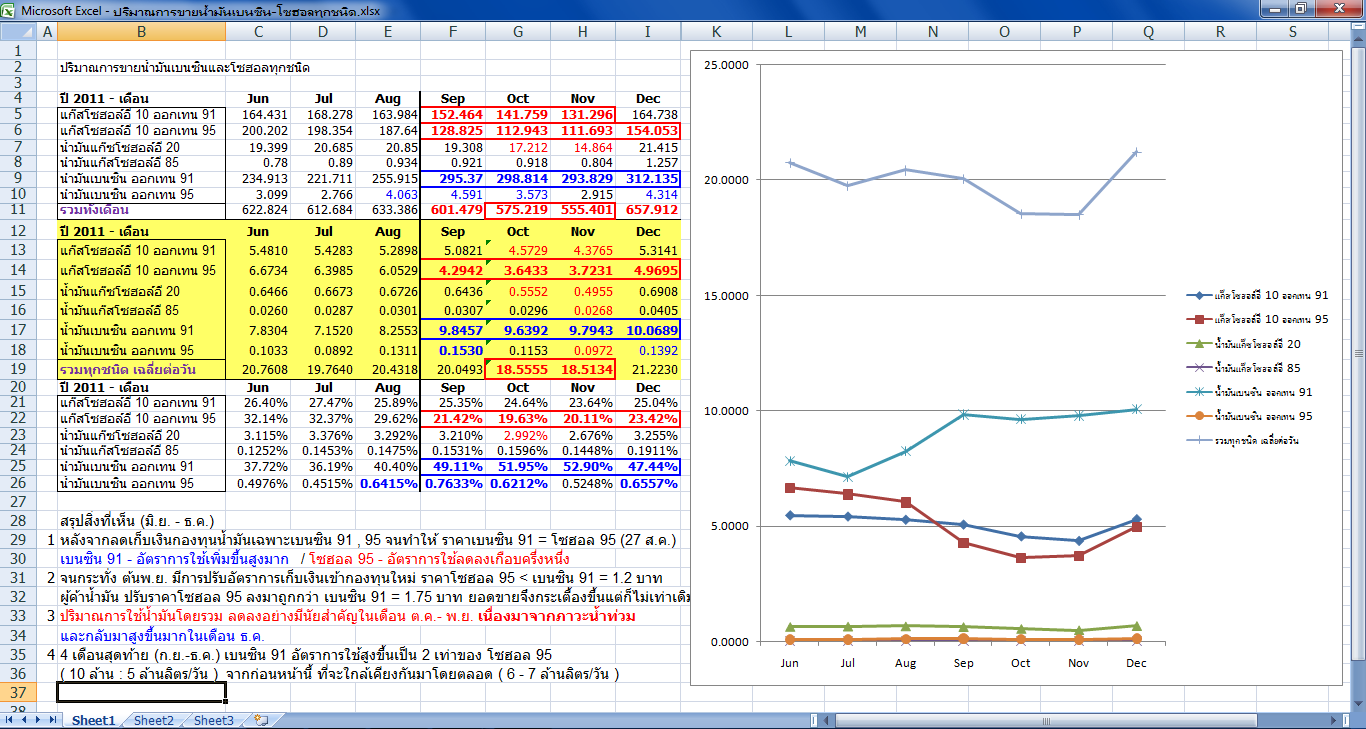

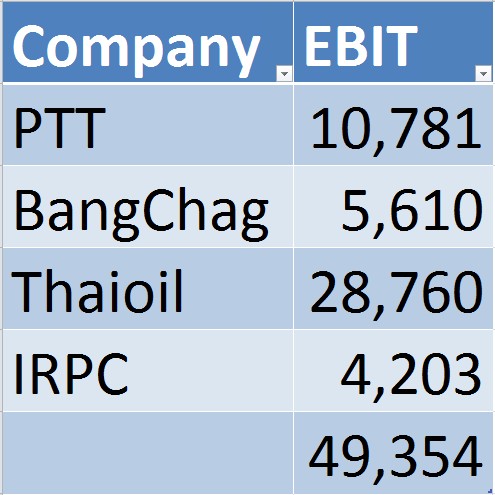

However, analysis of Porter's Five Forces does not tell the entire story. One reason why oil companies are so profitable is because of their high volume of goods sold. The following charts demonstrate that the oil companies are not profitable because of profit margins. Specifically, most companies (S&P 500 median) experience much higher profit margins than oil companies. The oil companies low profit margins suggests that oil companies are not making as much money per gallon as the average consumer assumes and that throughput is their key to profits.

Article เต็มๆ

สมแล้วที่เป็น เสนาธิการฝ่ายบุ๋น

สมแล้วที่เป็น เสนาธิการฝ่ายบุ๋น

เริ่มต้น คุยกันดีดี สักหน่อย เริ่มที่เราก่อนหล่ะครับ..ถ้าเรา ดี..แล้ว ผมเชื่อว่า เด๋วคู่ตอบโต้ ของเราคงจะดีขึ้น เย็นขึ้นเอง..

เริ่มต้น คุยกันดีดี สักหน่อย เริ่มที่เราก่อนหล่ะครับ..ถ้าเรา ดี..แล้ว ผมเชื่อว่า เด๋วคู่ตอบโต้ ของเราคงจะดีขึ้น เย็นขึ้นเอง..