About Thomson ReutersUPDATE 1-Japan deflation deepens as wholesale prices tumble

Thu Jul 9, 2009 9:00pm EDT Email | Print | Share| Reprints | Single Page[-] Text [+]

Market News

Wall Street ekes out gain on banks, materials

Nikkei rises 0.6 percent, Fast Retailing up on profit jump

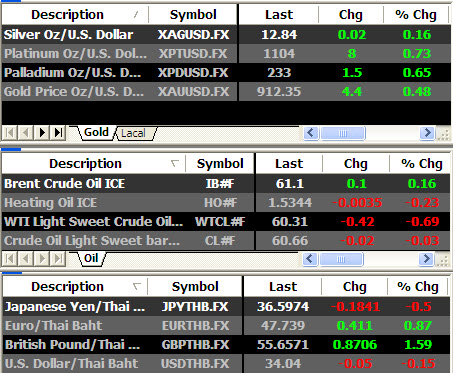

Oil rises, snaps six-day slide on gasoline buying

More Business & Investing News... (For more stories on the Japanese economy click [ID:nECONJP]) * Wholesale prices fall at a record 6.6 percent yr/yr * Drops in commodity costs, weak demand weigh on prices * Analysts say BOJ to remain cautious on economy

(Adds comments, details) By Tetsushi Kajimoto TOKYO, July 10 (Reuters) - Japanese wholesale prices fell 6.6

percent in the year to June, the biggest annual drop on record,

as the world's No.2 economy slides deeper into its second spell

of deflation this decade. Declines in oil and raw materials costs weighed on wholesale

prices, but falling final goods prices showed weak domestic

demand was also to blame as companies curb capital spending and

slash jobs following a record contraction in the first quarter. "The slide in wholesale prices is highly likely to widen in

July, August and September, exceeding 7 percent down the road.

Today's data would help the Bank of Japan reinforce its cautious

stance on the economy," said Tetsuro Sawano, senior fixed income

strategist at Mitsubishi UFJ Securities. Wholesale inflation has evaporated after hitting a 27-year

peak last August, as the global financial crisis sent commodity

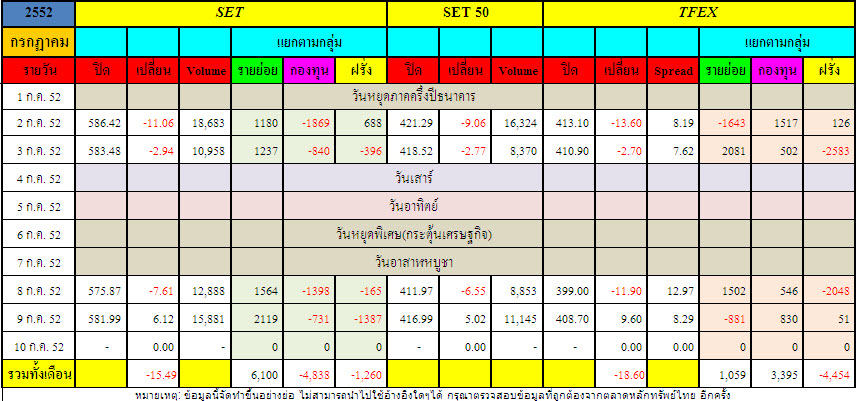

prices tumbling. The fall in the corporate goods price index was bigger than a

median market forecast for a 6.4 percent drop and followed a

revised 5.5 percent slide in the year to May, marking the sixth

straight month of annual declines. Reflecting weak demand at home, domestic final goods prices

dropped 2.6 percent in the year to June, the biggest decline

since 2002, pointing to further pressure on consumer prices,

which fell a record 1.1 percent in May from a year earlier. Wholesale prices have tended to move more sharply than

consumer prices, which fell 1.1 percent in the year to May.

Consumer price data for June will come out at the end of this

month. JPCPI=ECI For a graphic for Japan's wholsesale and consumer prices,

click: here Underlining the risk of deepening deflation and weakness in

final demand, the government estimates that supply capacity now

exceeds actual demand by 45 trillion yen ($484 billion) a year. The Bank of Japan and private-sector economists are

forecasting at least two years of deflation. While opinions are divided about whether this will be mild or

a more serious slide that prompts consumers to curb spending, the

BOJ says Japan is not facing such a deflationary spiral. The central bank policy board meets next Monday and Tuesday. The BOJ has cut interest rates twice to 0.1 percent in the

wake of the global financial crisis last year and taken steps

like buying commercial paper and corporate bonds and providing

low-interest funds to banks against corporate debt as collateral. As credit conditions ease, debate is likely to heat up within

the BOJ over whether to extend these corporate finance support

steps due to expire in September, while it tries to avoid sending

the wrong signal to an economy sinking deeper into deflation. Japan's gross domestic product will grow a modest 0.4 percent

in April-June, after a record 3.8 percent decline in the first

quarter, according to a Reuters poll, as companies slowly build

output and government stimulus trickles down. [ID:nLG69853] But analysts expect any recovery in Japan to be fragile as

many companies slash jobs and cut back on capital spending on

weak domestic demand.

($1=93.00 Yen)

(Editing by Hugh Lawson)

| จากคุณ |

:

tingtonggear

|

| เขียนเมื่อ |

:

10 ก.ค. 52 08:07:40

|

|

|

|

|

|

....

....

......

......