|

ความคิดเห็นที่ 12

ความคิดเห็นที่ 12 |

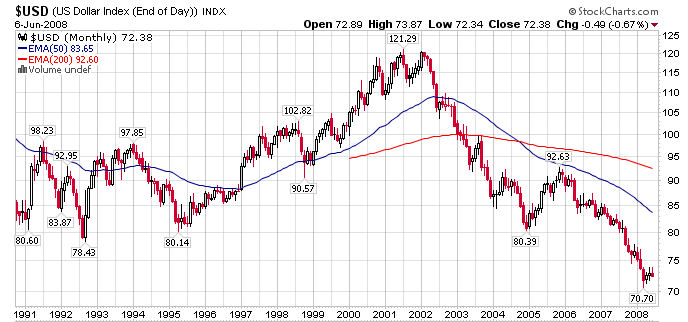

Another milestone event is as recent as early 2005.

This involved Warren Buffett the founder of Berkshire Hathaway (the fourteenth-largest U.S. company, according to the July 4, 2006 , issue of Fortune magazine).

When the financial media was pounding out news stories that

the dollar was in trouble, Warren made a statement that he was

heavily short the U.S. dollar.

Unfortunately, once he made that announcement, the dollar gained value

and rallied for most of 2005.

If you did not do your own research or homework and blindly

followed his advice, things did not turn out so well for you.

---

What may have contributed to the dollar rally in 2005 and

hurt Mr. Buffett's position was the fact that other players

may have been preying on his position.

Berkshire Hathaway, Inc., is without a doubt a high-profile player.

So when Warren Buffett announced he was going to cut back

speculative positions against the U.S. dollar after losing profits

due to surprising dollar strength, the buying to cover his shorts boosted the dollar.

Keep in mind that Mr. Buffett had bet that the dollar

would continue losing ground, as it did in 2004;

he felt the massive U.S. current account deficit

would be dollar negative.

But instead, monetary policy dictated otherwise,

as the Federal Reserve continued to raise interest rates.

That was helping to drive demand as the interest rate differentials widened. In its third-quarter report in 2005,

Berkshire Hathaway said it had cut its foreign-currency exposure

from $21.5 billion to $16.5 billion.

That was a significant amount of selling foreign currencies

and buying U.S. dollars.

แก้ไขเมื่อ 14 ก.พ. 53 00:27:52

| จากคุณ |

:

The Rounder

|

| เขียนเมื่อ |

:

14 ก.พ. 53 00:25:04

|

|

|

|

|

..

.. ..

..