|

ความคิดเห็นที่ 79

ความคิดเห็นที่ 79 |

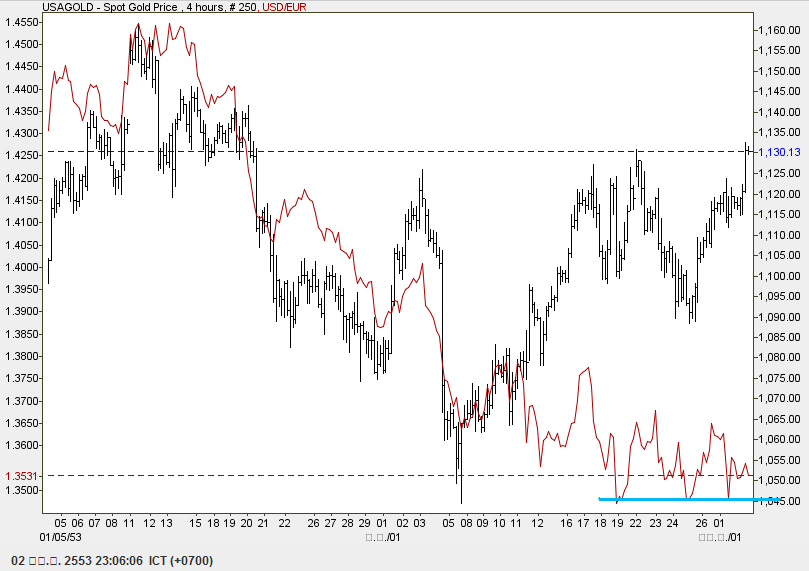

ใช่ข่าวนี้หรือเปล่าที่เกี่ยวกับเรื่องเงินปอนด์

STUPID is said to stand for Spain, Turkey, Ukraine, Portugal, Ireland and Dubai. That's six countries that got themselves into trouble with high borrowing over the last few years and now worry investors across the world.

With all due respect to Ukraine, it is not yet seen as a major economy which could destabilize the global market. But there are two U's who could easily qualify for the STUPID rogues' gallery: the United Kingdom and the United States.

On Tuesday a former UK chancellor of the exchequer warned that unless Britain got its act together and lowered the budget deficit it would be joining the STUPID list. The pound has been the whipping boy of the foreign exchange markets for months on fears over government spending and uncertainty over the outcome of the upcoming spring election.

All this talk of crisis for the pound was, on Monday, dismissed out of hand by David Bloom, head of HSBC foreign exchange research.

Those calling for a sterling crisis are living in ‘Cloud Cuckoo land,’ Bloom said. He also questioned which major currency the pound is going to have its crisis against?

"The analysts that are putting the GBP crisis view are the very same analysts who seem to be simultaneously predicting the breakup of the euro and a GBP crisis, whilst only last year telling us the USD was finished and losing its reserve currency status," he said.

So, if we assume Bloom is correct and talk of a sterling crisis is overdone could we make the case for the United States to join the STUPID party?

The US is expected to borrow $1.17 trillion in 2010, taking its national debt towards an amazing $15 trillion dollars. Harvard economist Niall Ferguson said as a result of this huge borrowing US government debt is a safe haven the way Pearl Harbor was a safe haven in 1941. This dwarfs UK borrowing, of course, and is being widely condemned by those in the US who believe runaway government spending is leading the country to ruin.

Risk aversion has seen investors ignore this analysis of America’s debt time bomb since the fall of 2009, as other problems outside of the US sent investors rushing back into the greenback. Unfortunately, data shows that the Chinese have cut back on buying US debt in recent months. A solution to the PIIGS problem and a credible plan for the UK economy after the election could see the focus return to the US deficit and investors would be STUPID to ignore the risk.

LinksList

* Pound's Tumble Nearly Done but Politics Loom

* UK Polls Point to Hung Parliament

* Greece Faces More Strikes as PM Plans More Cuts

| จากคุณ |

:

ฮะ ว่าไงนะ

|

| เขียนเมื่อ |

:

3 มี.ค. 53 14:28:06

|

|

|

|

|