|

เขาบอกว่าทองอาจต่ำกว่า1300

12 October 2010

By Walter de Wet*

Focus: Gold could drop below $1,300 in December

Much of the commodity strength, and dollar weakness, of recent weeks comes from expectations of further quantitative easing (dubbed “QE II”) by the Fed. Just how much of this is already priced in will be key for commodities, gold in particular. We use gold’s strong causal relationship with global liquidity to estimate how much QE the gold market is already pricing in.

Empirically, we find the long-term causal drivers of gold are global liquidity and real interest rates (see Commodities Insight: Global liquidity and real interest rates support gold of 11Aug’10). We define global liquidity as the Fed’s balance sheet plus global foreign reserve holdings (excluding gold). Gold trades around the long-term trend these two variables provide. All other factors are short-term drivers.

Lately, gold has diverged by some margin from the long-term trend provided by these causal drivers. Divergence by gold from this long-term trend is not unusual, but the speed, size and timing of its divergence coincide with the increasing expectations for further QE. We find that:

Firstly, for global liquidity to be consistent with the current gold price around $1,350, the Fed would have to expand its balance sheet by $500bn.

Secondly, a gold price closer to $1,280 would be consistent with the Fed announcing no further QE.

Thirdly, should the Fed provide $1trn in additional QE, a gold price closer to $1,400 should follow.

There are many different estimates of the possible size of another round of QE, ranging from $100bn per month, staggered over a number of months, to a $1trn shock-and-awe infusion. The market will be searching the minutes of the September FOMC meeting for clues on further QE.

With our belief that gold is pricing in substantial QE already, combined with the fact that scrap continues to come to the market at the current gold price, a conservative approach on QE by the Fed could see gold drop below $1,300 in December. This may be amplified by seasonal jewellery demand (which we expect to decline December).

While we remain bullish on gold into 2011, we could see gold even at $1,260 - a point at which major technical support lies.

Base metals

As with the rest of the commodities complex, the focus for base metals remains global macroeconomic policy and its effect on currencies. With China back from holiday, volumes are picking up. However, LME week is in full swing in London, and as a result, overall market interest may remain subdued.

Although there is some buying interest in copper in Shanghai, the LME/SFE arbitrage ratio remains low — at 7.53 this morning. This ratio still favours no aggressive LME buying from China. However, we continue to notice signs of a tightening copper market, with time spreads tightening and premia in Asia remaining firm despite the latest rally in copper.

Zinc continues to find support above the $2,300 level. However, there may be some concern over a possible downward correction in zinc as demand for puts seem to be on the increase (with open interest in Dec’10 puts rising). We expect the zinc market to be in a 298K mt surplus in 2010 and 98K mt surplus next year. In contrast, we expect lead to push higher. Lead has lagged zinc in recent days but, fundamentally, we continue to see support for the metal into 2011, with a deficit in the lead market estimated at 67K mt for 2011.

We believe that base metal prices will be driven by expectations of further easing by the Fed until the FOMC meets on 3 Nov’10. We therefore look to macroeconomic themes in the next two weeks, rather than metal specifics.

Precious metals

After gold’s brief surge yesterday, the stronger dollar is now weighing down gold. Physical demand has all but evaporated, and investors are in a tentative mood ahead of the release of the FOMC minutes — awaiting signals of further quantitative easing. We estimate the current gold price implies about another $500bn of monetary accommodation from the Fed. However, fixed income markets seem to be looking for an additional $1tr, which would place considerable upward momentum on gold. However, the Fed may decide to stagger additional QE instead of flooding the market.

Gold support is at $1,339 and $1,330. Resistance is at $1,355 and $1,362.

Silver continues to mirror movements in the gold market, with the stronger dollar stifling physical buying. Silver support is at $22.86 and $22.64, resistance is at $23.47 and $23.84.

PGM’s should react similarly to signs of more monetary accommodation in the FOMC minutes. However, the response might be downplayed by concerns over a faltering US economy impacting negatively on industrial demand for platinum and palladium.

Platinum support is at $1,668 and $1,653, resistance at $1,705 and $1,725. Palladium support is at $583 and resistance at $592.

Energy

Crude oil fell yesterday as the dollar strengthened. The trade weighted dollar index closed up by 0.15% yesterday, while front-month WTI closed the session down 45c/bbl. Front-month WTI, Brent, ICE gasoil and Nymex heating oil all closed below their 5-day and 8-day moving average, with only Nymex RBOB as the exception staying above the 5-day and 8-day moving average.

The strike at French ports of Fos and Lavera enters its 16th day, with no ending yet to be seen. It has been reported that the La Mede Refinery with 157kbd crude distillation capacity is shutting down due to crude shortage. And seven other refineries relied on the import via the ports are reported running at a reduced rate. The strike has pushed down spot Urals Med diff vs. Dated Brent to an eight-week low of -$1.63/bbl. Another impact has been a reduced gasoline export to the US, which boosted RBOB cracks in recent weeks.

The trend of dollar strengthening and oil weakening continues this morning. Technically, the future contracts are heading down to their 13-day moving average. Before the delayed API and ODE inventory release, the oil market will follow directions of the currency markets and its own technical signals. Other things to watch include the latest OPEC monthly report later today, followed by IEA monthly report and EIA’s outlook tomorrow.

| จากคุณ |

:

ฮะ ว่าไงนะ

|

| เขียนเมื่อ |

:

13 ต.ค. 53 14:42:43

|

|

|

|

|

เปิดบ้านค่ะ

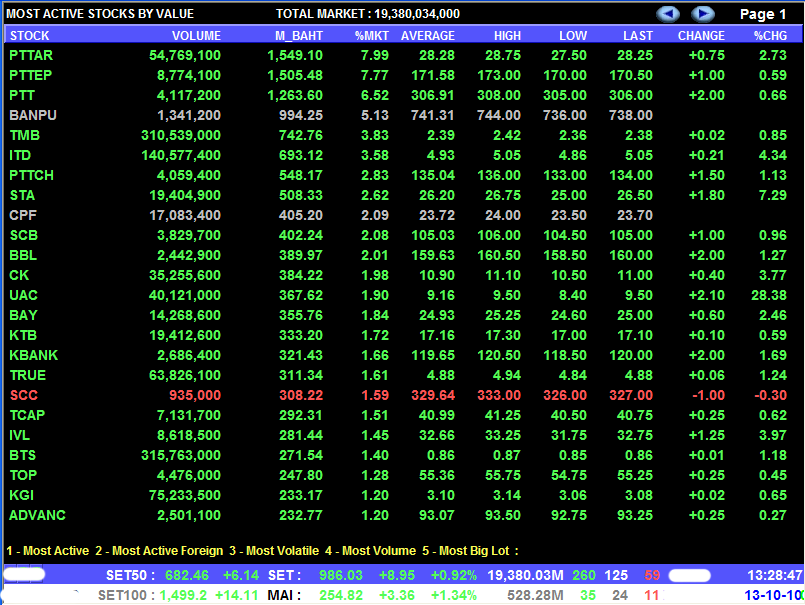

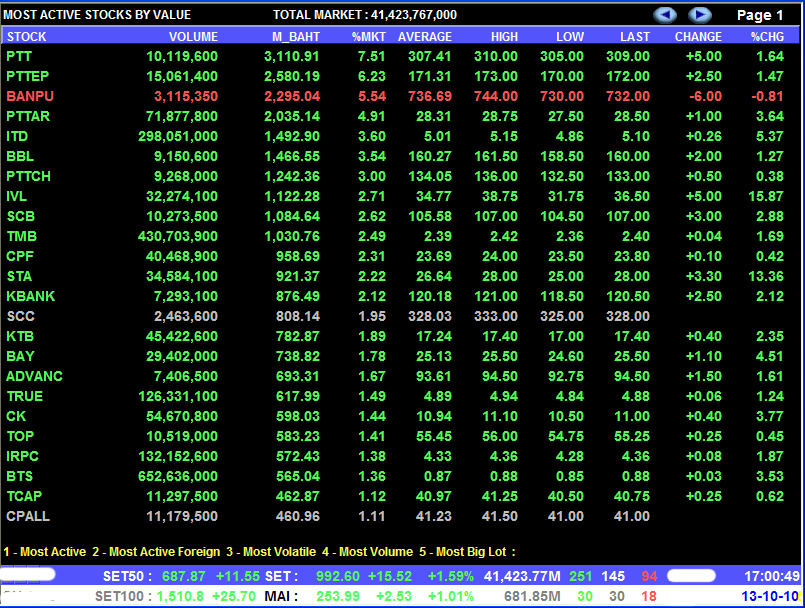

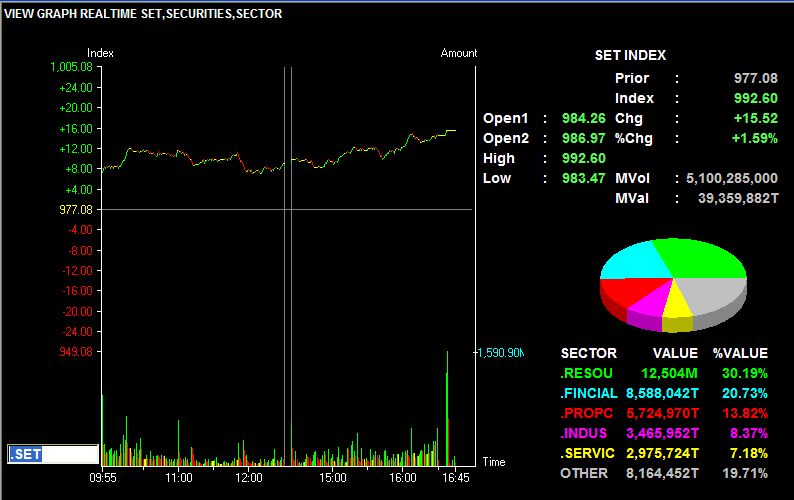

เปิดบ้านค่ะ เมื่อวานปู่ปิดที่ 977.08 จุด คิดเป็น -0.77 จุด

เมื่อวานปู่ปิดที่ 977.08 จุด คิดเป็น -0.77 จุด

มาคุยกันค่ะ

มาคุยกันค่ะ

"ฉันรักเธอ" "ฉันรักเธอ" "ฉันรักเธอ" "ฉันรักเธอ" "ฉันรักเธอ"

"ฉันรักเธอ" "ฉันรักเธอ" "ฉันรักเธอ" "ฉันรักเธอ" "ฉันรักเธอ"

สวัสดีครับพี่จีนี่ พี่ฟ้าใส พี่ข้างบูรพา พี่กุ้ง พี่กี้บลู พี่graratea พี่แวน พี่่ดอกไม้ พี่ Kading พี่สาม พี่แมม น้องปุ๋ม นู๋ไผ่ พี่ซี พี่be real พี่อิ๋ง พี่ปุ๊ต๋ง พี่น้องหนู พี่tarojay พี่แพร์พี่ปันปัน พี่ worthneverdie พี่ Noopy&Wood พี่ ขาหมู (Ooh 1234) พี่ jejeeppe พี่ จันทร์พ้นเมฆ พี่่worthneverdie พี่ not defendant พี่ spicky พี่ยากแท้หยั่งถึง น้องกระต่ายสีเขียว พี่ "เลขาฯ ตัวแสบ!" พี่อ้วนตุ้ยนุ้ย และรอบวงครับ

สวัสดีครับพี่จีนี่ พี่ฟ้าใส พี่ข้างบูรพา พี่กุ้ง พี่กี้บลู พี่graratea พี่แวน พี่่ดอกไม้ พี่ Kading พี่สาม พี่แมม น้องปุ๋ม นู๋ไผ่ พี่ซี พี่be real พี่อิ๋ง พี่ปุ๊ต๋ง พี่น้องหนู พี่tarojay พี่แพร์พี่ปันปัน พี่ worthneverdie พี่ Noopy&Wood พี่ ขาหมู (Ooh 1234) พี่ jejeeppe พี่ จันทร์พ้นเมฆ พี่่worthneverdie พี่ not defendant พี่ spicky พี่ยากแท้หยั่งถึง น้องกระต่ายสีเขียว พี่ "เลขาฯ ตัวแสบ!" พี่อ้วนตุ้ยนุ้ย และรอบวงครับ

กระจ่างเลยค่ะ

กระจ่างเลยค่ะ

ก กกกกกกกกกกกกกกกกกกกกกกกกกก

ก กกกกกกกกกกกกกกกกกกกกกกกกกก