|

ขออนุญาต แปะข่าว Shortge of boPET film supply นะครับ

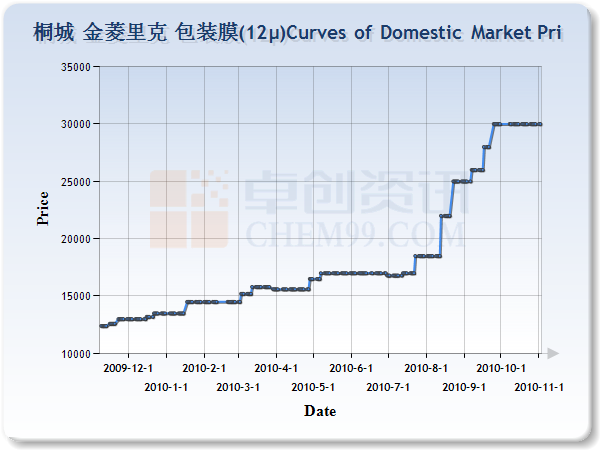

MUMBAI (ICIS)--Prices of biaxially oriented polyethylene terephthalate (BOPET) film in India look set to continue rising through to 2011 amid increased demand and tight supply, industry sources said on Monday.

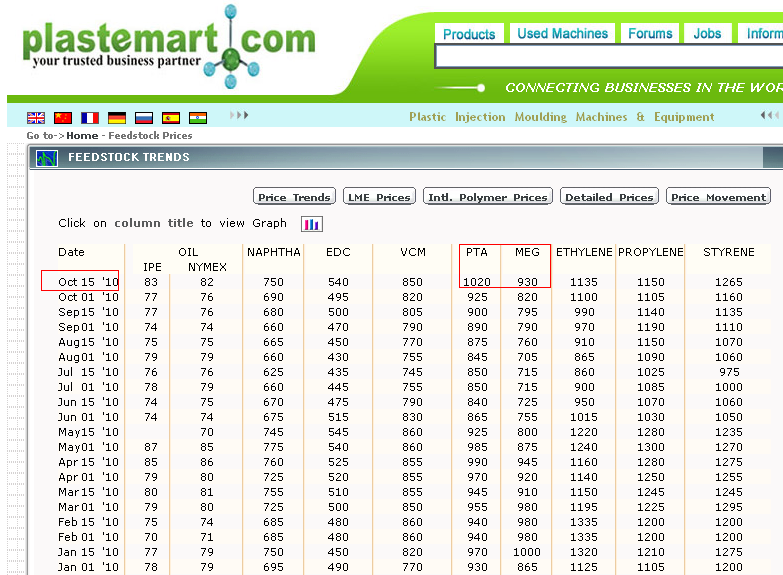

The benchmark 12 micron BOPET could hit Rs240-250/kg ($5,407-5,631/tonne) this month from around Rs227/kg in end-September, after nearly doubling its value from the start of the year because of strong demand, they said.

Domestic demand was expected to grow nearly 25% annually in the next two years as new uses for BOPET emerge, industry sources said.

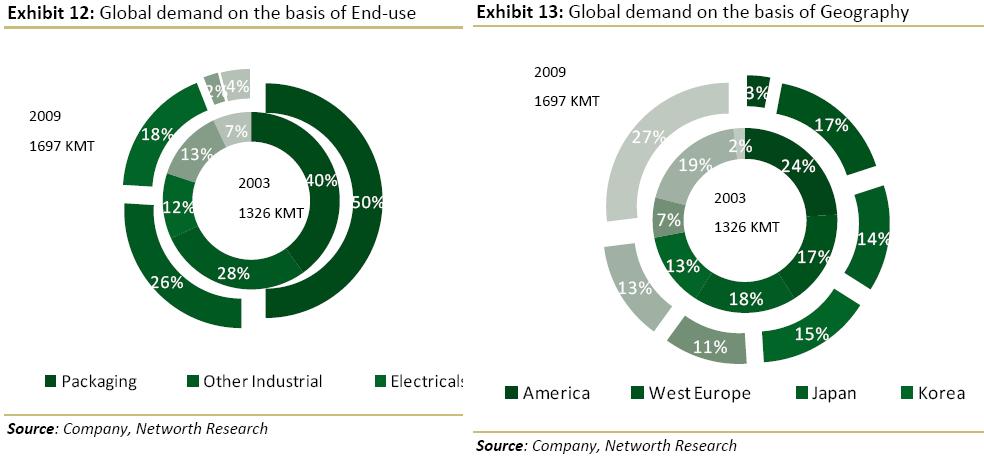

BOPET is a polyester film with applications in packaged foods, solar power cells, touch-screen panels of mobile phones and flat screen televisions.

An increase in the use of the material in non-traditional areas such as garment embroidery, along with exports to the US and Europe - where BOPET production had started to fall - ate into available domestic supply, causing prices to shoot up, industry sources said.

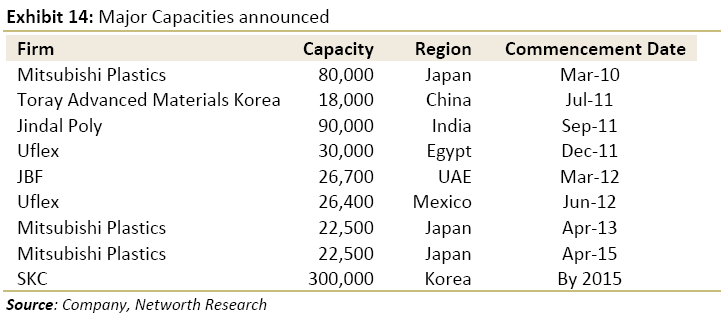

“Production capacities in the matured markets of USA, Europe and Japan are declining and large growth is being witnessed in Asia where capacity increase is continuing,” major Indian producer Jindal Polyfilms said on its website.

“Many polyester film producers in the mature markets are shifting towards making specialty products,” said a source at an Indian film producer with operations in India, Middle East and South America.

But in Asia, demand for BOPET was growing at a fast pace in the past few months, driven by the region’s stronger economic growth, industry sources said.

The region was expected to account for 60% of worldwide BOPET film sales over the next year, according to the website of Jindal Polyfilms.

“Rapid economic growth in India and China is creating larger opportunities for the use of flexible packaging film,” said the source.

BOPET’s price spike, however, was hurting plastic converters as they had to deal with higher production overhead, industry sources said.

“We are suffering,” said a source at a major Indian converter, citing that the price increased had been gradual and reasonable this year until June, when values started their rapid increase.

Converters alleged that Indian polyester film producers had formed a cartel of sorts with all the companies quoting similar prices, leaving converters with no options but to buy film at the high rates.

The polyester film producers, on the other hand, said that the strong demand dictated the strong prices.

“Some converters are increasingly moving towards biaxially oriented polypropylene (BOPP) film as it is a cheaper alternative. In some cases, converters are trying to replace metallized polyester film with metallized BOPP or even aluminium foil, which is cheaper,” said the source at the Indian converter.

BOPP film prices have remained more or less stable in the past eight to nine months, with the benchmark 18 micron BOPP film, costing around Rs114/kg due to ample supply, market sources said.

“In addition to existing BOPP producers, most polyester film producers are also setting up BOPP production facilities, which has led to increased capacity in the market,” said the polyester film producer.

However, though BOPP film is cheaper, not all converters have been able to make the shift since machine specifications could not be changed overnight and there were some applications that BOPP could not substitute for BOPET, industry sources said.

“If BOPET film prices rise beyond Rs250/kg, it could damage the downstream industry especially the packaging sector,” said the source at an Indian converter, citing that converters may not be able to pass on the higher cost to customers.

Some market players, however, said that the spike in BOPET prices may not extend up to two years as others believed.

“There is increased capacity coming into the market. Many of the existing producers are also increasing their capacity, so at most this spike in prices may last for six to seven months more,” the first film producer said.

“There is huge capacity coming up in China, which should increase availability [of BOPET] by next year. So hopefully, we will be able to see a drop in prices,” said the converter.

($1 = Rs44.39)

Read John Richardson and Malini Hariharan’s blog – Asian Chemical Connections

| จากคุณ |

:

Grand Marshal1

|

| เขียนเมื่อ |

:

5 พ.ย. 53 00:22:19

|

|

|

|

|

ขอบคุณสำหรับข้อมูล ให้เครดิตเจ้าของกระทู้เลยคะ แล้วจะติดตามอ่านเรื่อยๆ คะ

ขอบคุณสำหรับข้อมูล ให้เครดิตเจ้าของกระทู้เลยคะ แล้วจะติดตามอ่านเรื่อยๆ คะ