|

Oil Prices Fall as China's Economy Heats Up?

Analysis | Commodity Technical Analysis | Written by optionsXpress | Fri Jan 21 11 10:56 ET

Today's Idea

Since August of 2010, Crude Oil futures have made a series of higher highs and higher lows, although the path higher has been marked by moderate "corrections" that have put Oil bulls' resolve to the test. A look at the daily chart for March Crude shows solid chart support located between 85.00 and 82.00, which if violated to the downside may be the signal that the up-trend has run its course. Some traders who believe that the support area will hold may wish to explore selling puts in March Crude Oil with a strike price below the lower level of support near 82.00. For example, with March Crude Oil trading at 89.57 as of this writing, the March Oil 78 puts could be sold for about 0.15, or $150 per option, not including commissions. The premium paid would be the maximum potential gain on the trade and would be realized if March Oil is trading above 78.00 at option expiration in mid-February. Given the risks involved in selling naked options, traders should have an exit strategy in place should the position move against them. An example of one such strategy would be to buy back the puts sold before expiration should March Crude close below the 200-day moving average (currently near 84.10).

Fundamentals

Today's headline may seem a bit conflicting at first, but traders fear a red hot Chinese economy may lead to further tightening measures that may potentially put the brakes on the premiere growth engine in Asia. The latest data on 4th quarter GDP showed a growth rate of 9.8%, which is well above the 9.4% rate most analysts were expecting. With China's inflation rate running above government target levels, many traders fear the Chinese Central Bank will be forced to take stronger measures to help tame its robust economy. Due to this "perceived" possibility of a slowdown, commodity futures prices have fallen during the past few trading session, with March Crude Oil falling over $4 per barrel from highs made just a few days ago. Many traders have been in a bullish mode regarding Oil until recently, as strong Asian demand combined with some signs of economic improvement in the U.S. had some prominent analysts targeting Oil for another run at $100 per barrel. Oil bulls got no help from this week's EIA energy stocks report, which reported a gain of 2.617 million barrels of Crude last week, vs. the pre-report estimate of a draw of about 1.4 million barrels. With speculators holding a near-record net-long position in Crude Oil, a decent price correction may be necessary to restore health to the bull market, as late and weak longs are taken out of their positions. It may be after this "washout" that prices may once again resume their upward climb, unless we finally see some "actual" evidence of a slowing Chinese economy and not just the fear of such an occurrence in the coming months.

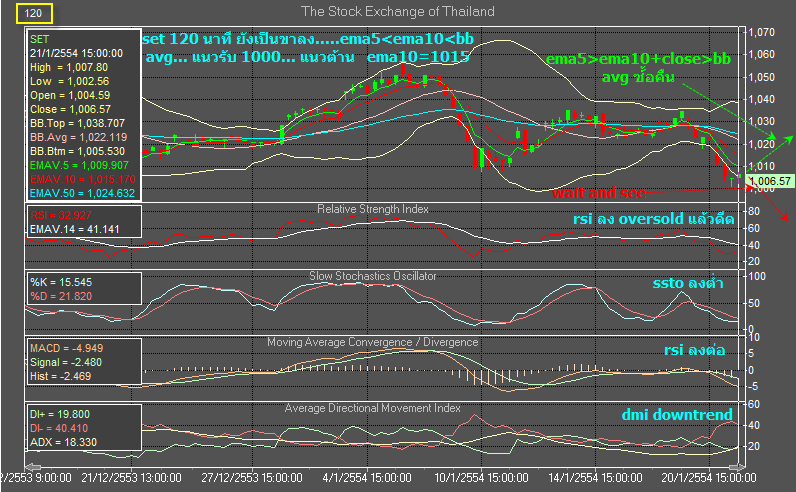

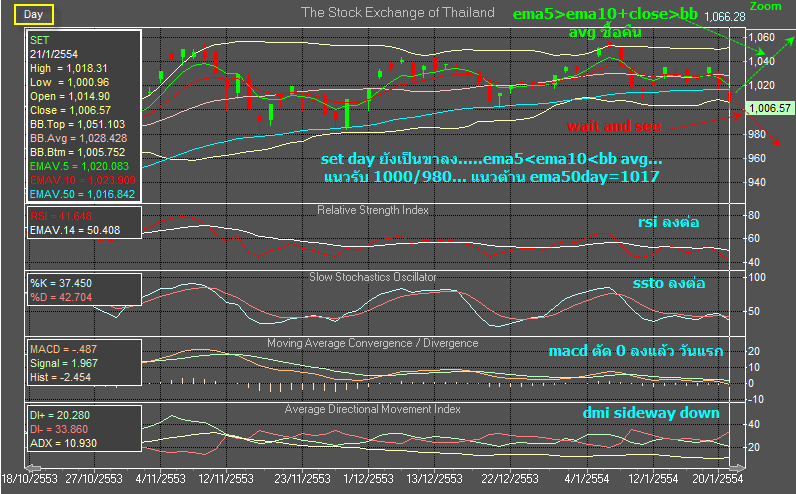

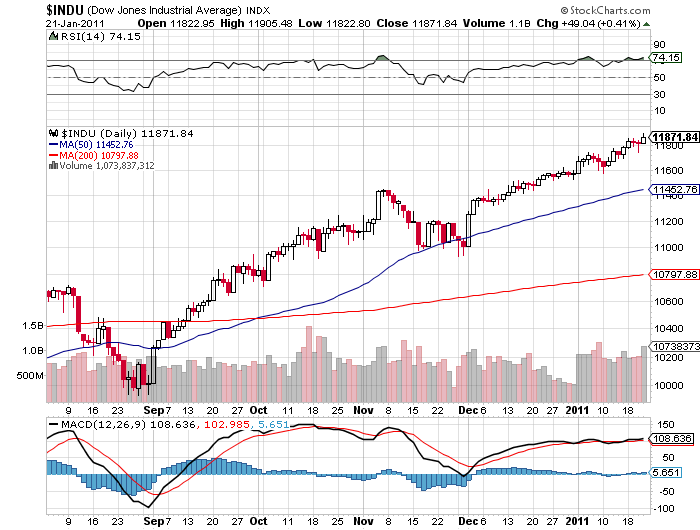

Looking at the daily chart for March Crude Oil, we notice yesterday's sharp sell-off sent prices below the 20-day moving average at the close for the first time in several sessions. Despite this weak performance, prices failed to reach the recent low of 88.45, which is the nearest support level. It certainly is possible that March Crude prices might be looking to consolidate between the recent high of 93.46 and the December 15th low of 88.07 for a bit until the market determines its next move. There is a bearish divergence forming in the 14-day RSI which would be confirmed should March Oil close below the bottom end of the aforementioned price range.

| จากคุณ |

:

ฮะ ว่าไงนะ

|

| เขียนเมื่อ |

:

22 ม.ค. 54 08:40:10

|

|

|

|

|

สวัสดีครับพี่ปรัชญา

สวัสดีครับพี่ปรัชญา

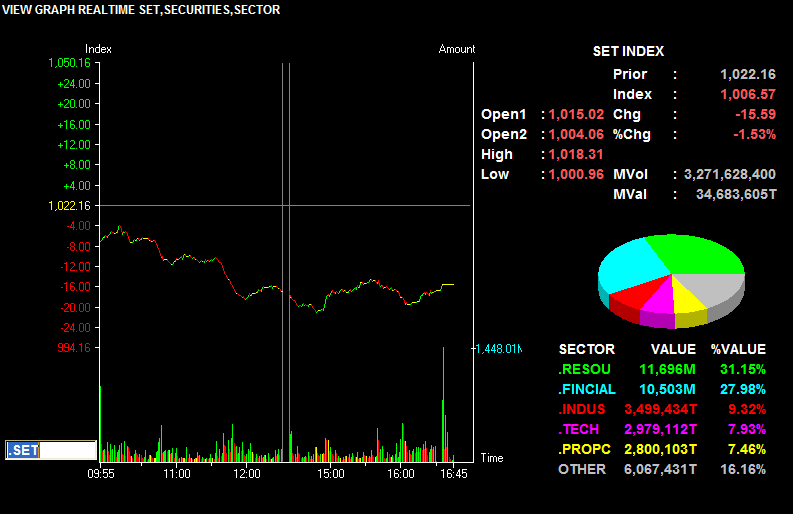

หุ้นก็ตก

หุ้นก็ตก

... หวัดดีฮับทุกท่าน เย็นนี้ไปเดินคลองถมดีก่า ... แบ่ร แบ่ร

... หวัดดีฮับทุกท่าน เย็นนี้ไปเดินคลองถมดีก่า ... แบ่ร แบ่ร