|

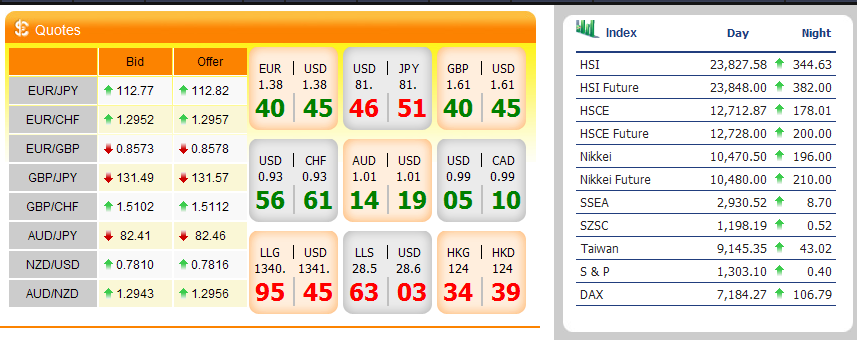

The bull market in Gold is in its 12th year (globally it began in 1999) but has yet to exhibit any 'bubble-like' conditions. In fact, we still see many people referring to this bull market as 'the Gold trade,' as if its an aberration that needs to be reversed or corrected. That aside, we know that Gold is under-owned as an asset class. The very well respected BCA Research estimates that globally only 1% is allocated to Gold and that fits with some of the charts that I've shown in the past.

Institutional accumulation began in 2009 (e.g. Paulson, Einhorn) and we know that phase lasts at least a few years before a bull market gives birth to a bubble.

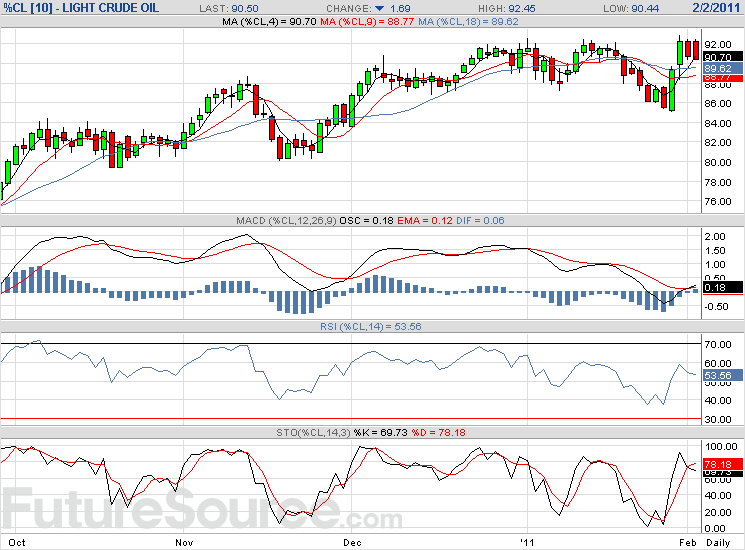

Part of the problem for Gold has been the solid performance of other asset classes through most of the Gold bull market. Stocks performed very well from 2003 to 2007 and from 2009-2010. Commodities performed well from 2001-2002 and in the first half of 2008. If stocks are doing well or if commodities such as oil and agriculture are performing well, it detracts from Gold. Gold performs its absolute best when the other asset classes underperform or don't perform too well.

Let me explain the conditions and setup that will facilitate the birth of a bubble and Gold going mainstream.

First, stocks are going to peak in Q2 of this year and enter a mild cyclical bear market. The chart below details the previous three secular bear markets and the template that each follows. After the mid-point crash (i.e 1907, 1938, 1974 and 2008) the market rallied significantly over the next one to two years. After that rally stocks went into a mild cyclical bear market for several years.

Those periods were associated with rising commodity prices, rising interest rates and rising inflation. Sounds like history could repeat again.

In the next year there is a good chance that we'll see stocks and bonds in a bear market, simultaneously for the first time since the late 1970s. It is at that point that hard assets will emerge and mainstream managers will no longer be able to ignore that barbarous relic. This could begin as early as Q2 of this year or as late as 2012. It is hard to say but we think it begins somewhere in the middle.

Here is why the backdrop will ultimately support Gold and not stocks or bonds.

Economic growth is simply too low and too meager to put any dent into debt to GDP ratios. The economy is recovering but the debt load is growing larger. Two trillion dollars was added to the national debt in FY 2010. The CBO just came out and projected a deficit of $1.5 Trillion in FY 2011. This is why monetization will not only continue but it will be more frequent and in larger amounts.

We already see the effects. Inflation is rising and interest rates may be in a new cyclical uptrend. These are the factors and not deflationary conditions, which will cause the next mild bear market and mild recession. We say mild because the private sector was in recession for three years of the last decade. The survivors are better able to handle any current difficulties. In fact, the credit markets and the global economy have improved. After a recession like 2007-2009, there tends to be a slow but arduous period of recovery for the private sector.

Slowing economic growth and a mild recession can give bonds a boost to some degree but it won't reduce the need for monetization. Remember, from 2004-2007 we had a housing boom, strong global growth and the budget deficit declined. With no housing recovery in sight, the likelihood of higher interest rates and more of the budget devoted to interest expense, the reality is continued monetization. This doesn't include the potential for bailouts to states and municipalities, which also comprise a part of GDP. No bailouts there and the economy will be affected.

In the early 1980s, we had the ability to raise interest rates and defeat inflation. This time around, there is no realistic and hope and no legitimate solution other than a new monetary regime. We all know the economy cannot grow out of this mess. Furthermore, we know that higher rates will only lead to eventual bankruptcy. Debt levels in the US, Japan and Europe are already too large. Higher interest rates will raise debt service costs and this will eventually lead to default or hyperinflation. Huge government debt wasn't a problem 30 years ago.

We've discussed some macroeconomic factors but now let's look at the charts so you can visualize the precious metals complex, where it is and where it is going in the next few years.

| จากคุณ |

:

ฮะ ว่าไงนะ

|

| เขียนเมื่อ |

:

2 ก.พ. 54 06:24:57

|

|

|

|

|

สวัสดีครับพี่ปรัชญา

สวัสดีครับพี่ปรัชญา

มาแล้วววววววววววววว

มาแล้วววววววววววววว