|

มุมมองเกี่ยวกับQE3ครับ

แปลเองนะครับ

ภาษาไม่แข็งแรงอะครับ

Chicago (Kitco News) - If the Federal Reserve can provide additional stimulus to the U.S. economy, it would give the biggest price support to commodities for the rest of the year as investors again will seek to snap up hard assets.

“If we had, as I call it ‘QE3D’ – since every movie now is in 3D – then prices for commodities will soar again. It would be the most bullish factor,” said Phil Flynn, energy analyst for PFG Best Research.

Fed Chairman Ben Bernanke said in front of the U.S. Congress on Wednesday that the Fed is examining several untested ways to promote growth in economic conditions crumble.

This comes on the heels of minutes from the June Federal Open Market Committee released late Tuesday that showed some members would be in favor of additional stimulus if the economy faltered.

The combination of those two comments sent gold prices to record levels and triggered a substantial rally in the stock market on Wednesday.

Flynn spoke as part of a panel at Dow Jones Indexes’ Mid-Year Commodity Review and Outlook here.

When the Fed’s second quantitative easing program ended in June, it coincided with the drop in commodity prices across the board, and Flynn said without any addition stimulus prices would retreat. He said without a third stimulus program and with the outlook for global demand slowing into the fourth quarter, crude oil prices could be around $85 a barrel. “If they do a QE3, then that’s wildly bullish. Instead of $85 we could see $110-$120 oil. That would also have a significant impact on heating and gasoline,” he said.

August contract crude oil prices on the New York Mercantile Exchange were trading around $98.62 a barrel on Wednesday.

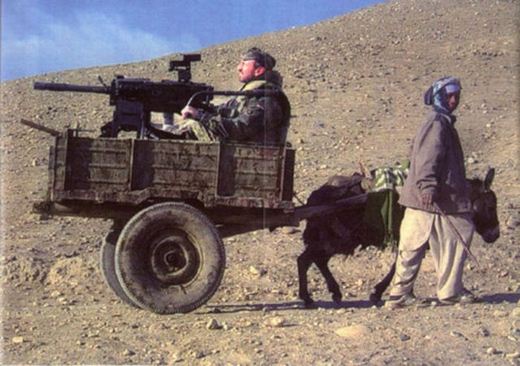

On a side note, he said the riots in some Middle Eastern countries, known as the Arab Spring, have had an impact on gasoline prices. The price spread between Brent crude oil, the European benchmark and West Texas Intermediate crude oil, the U.S. benchmark, widened sharply because of the loss of Libyan crude oil production. Because of that sharp price difference, the release of crude oil reserves by the International Energy Administration was the right move, he said.

“There was real tightness of light, sweet crude supply in Europe. The reserves are there for a time of war and there is war,” Flynn said.

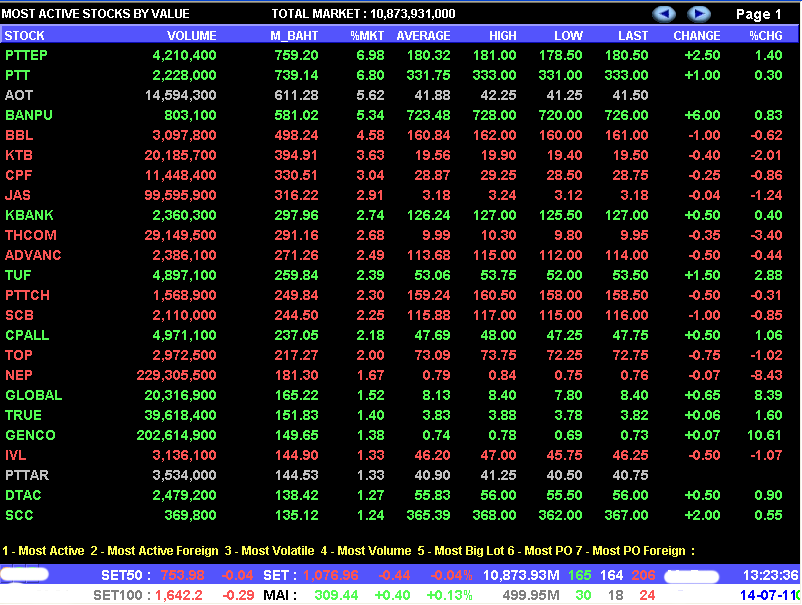

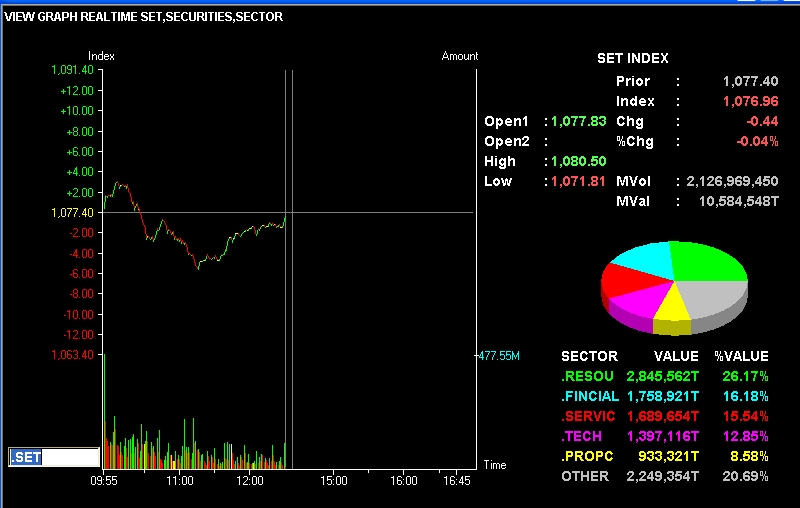

Commodity Index Down Slightly On Year

The Dow Jones-UBS Commodity Index is down 2.62% for the first half of the year, said John Prestbo, editor and executive director of the Dow Jones Indexes. Precious metals were the best-performing sector within the index, gaining 6.82%, while grains were the worst-performing sector, sliding 9.72%, he said. For comparison, the Dow Jones Industrial Average stock market index is up 6.37% for the first six months of 2011.

Prestbo noted that investors are continuing to put money in the commodities market, with $76.9 billion tracking the DJ-UBS Commodity Index, up from $62 billion as of Dec. 31.

John Kowalik, an executive director with UBS’ Commodities Investor Group, said money managers are offering commodities as inflation protection for their investor clients, rather than simply a stand-alone part of their portfolio.

"Commodity investing (has) … become an important component of new-investment strategies such as inflation protection and absolute-return products. In addition to pure index-based investing, investors and investment managers continue to seek improved returns through the use of enhanced index strategies, such as forward indexes, and by using commodity subindexes to modify their portfolios' risk exposure," he said.

He also said institutional investors are taking a “slow and steady” view of commodity investing and are not reacting to volatile day-to-day market action.

There has been a lot of discussion about “excessive speculation” but neither Kowalik nor Flynn said they have seen it.

Comments about excessive speculation come around when “markets don’t do what (people) want them to do,” Flynn said.

He said the rise in commodities prices is a side-effect of the loose monetary policy. “The government and the Fed don’t want to admit it has an effect on prices. They say they kept the markets from crashing, but they don’t want to say what it did to the dollar and how it raised commodity prices,” he said.

| จากคุณ |

:

ฮะ ว่าไงนะ

|

| เขียนเมื่อ |

:

14 ก.ค. 54 10:37:13

|

|

|

|

|

สวัสดีครับพี่จีนี่ พี่ฟ้าใส พี่ข้างบูรพา พี่กุ้ง พี่กี้บลู พี่ยากแท้หยั่งถึง พี่ ฮะว่าไงนะ พี่ saimai77 พี่graratea พี่แวน พี่่ดอกไม้ พี่ oready พี่สาม พี่แมม น้องปุ๋ม นู๋ไผ่ พี่ซี พี่be real พี่อิ๋ง พี่ปุ๊ต๋ง พี่น้องหนู พี่tarojay พี่แพร์ พี่ปันปัน พี่ worthneverdie พี่ Noopy&Wood พี่ THALAY2 พี่ jejeeppe พี่ จันทร์พ้นเมฆ พี่่โต้คลื่น พี่ ชาญดำ พี่ nextdoor น้องกระต่ายสีเขียว พี่ "เลขาฯ ตัวแสบ!" พี่อ้วนตุ้ยนุ้ย พี่ Na_bird พี่ คุณป้าพาเพลิน พี่ halogen พี่โตตรอกจันทร์ พี่เกือบไม่ได้มาแล้ว พี่ elvish346 พี่8088-xt พี่ Horizon23 พี่ Atom_s พี่Dal ja พี่ baridhara พี่ ตี๋แก้มยุ้ย พี่หยองแหยง พี่venezier พี่ rocky mountain พี่michita พี่มือเก่าหัดขับ พี่notsugar พี่มิ่งกลิ้ง พี่สาระขัน พี่*+*+ChoCoLateDesserts+*+* พี่LightStream1010 พี่คุณหญิงจิ๋วแจ๋ว พี่น้าหมีอ้วน พี่่Dr.D70 พี่OKANEMOCHI พี่feel lonely พี่@งั้นแหละ@ พี่มองได้..แต่อย่าชอบ พี่นิภาโชติ พี่ Little Calf พี่Juneman พี่ไม่อยากตกรถ พี่THE FINAL 2 พี่The Fast And Furious พี่RANNY พี่เกือบไม่ได้มาแล้ว พี่Joe_worrarit พี่สังขยาใบเตย พี่1st class newbie และรอบวงครับ

สวัสดีครับพี่จีนี่ พี่ฟ้าใส พี่ข้างบูรพา พี่กุ้ง พี่กี้บลู พี่ยากแท้หยั่งถึง พี่ ฮะว่าไงนะ พี่ saimai77 พี่graratea พี่แวน พี่่ดอกไม้ พี่ oready พี่สาม พี่แมม น้องปุ๋ม นู๋ไผ่ พี่ซี พี่be real พี่อิ๋ง พี่ปุ๊ต๋ง พี่น้องหนู พี่tarojay พี่แพร์ พี่ปันปัน พี่ worthneverdie พี่ Noopy&Wood พี่ THALAY2 พี่ jejeeppe พี่ จันทร์พ้นเมฆ พี่่โต้คลื่น พี่ ชาญดำ พี่ nextdoor น้องกระต่ายสีเขียว พี่ "เลขาฯ ตัวแสบ!" พี่อ้วนตุ้ยนุ้ย พี่ Na_bird พี่ คุณป้าพาเพลิน พี่ halogen พี่โตตรอกจันทร์ พี่เกือบไม่ได้มาแล้ว พี่ elvish346 พี่8088-xt พี่ Horizon23 พี่ Atom_s พี่Dal ja พี่ baridhara พี่ ตี๋แก้มยุ้ย พี่หยองแหยง พี่venezier พี่ rocky mountain พี่michita พี่มือเก่าหัดขับ พี่notsugar พี่มิ่งกลิ้ง พี่สาระขัน พี่*+*+ChoCoLateDesserts+*+* พี่LightStream1010 พี่คุณหญิงจิ๋วแจ๋ว พี่น้าหมีอ้วน พี่่Dr.D70 พี่OKANEMOCHI พี่feel lonely พี่@งั้นแหละ@ พี่มองได้..แต่อย่าชอบ พี่นิภาโชติ พี่ Little Calf พี่Juneman พี่ไม่อยากตกรถ พี่THE FINAL 2 พี่The Fast And Furious พี่RANNY พี่เกือบไม่ได้มาแล้ว พี่Joe_worrarit พี่สังขยาใบเตย พี่1st class newbie และรอบวงครับ

..และข้อมูลข่าวสาร

..และข้อมูลข่าวสาร ..กาแฟหอมๆ และเมนูอาหารน่าทานน่าทาน

..กาแฟหอมๆ และเมนูอาหารน่าทานน่าทาน

นะ .............

นะ .............