|

คิดไม่ออก ว่าจะกระทบยังไง ก็พยายาม ติดตามอ่านข่าวดีกว่านะ

Week Ahead: Markets Will Sort Through Credit Downgrade

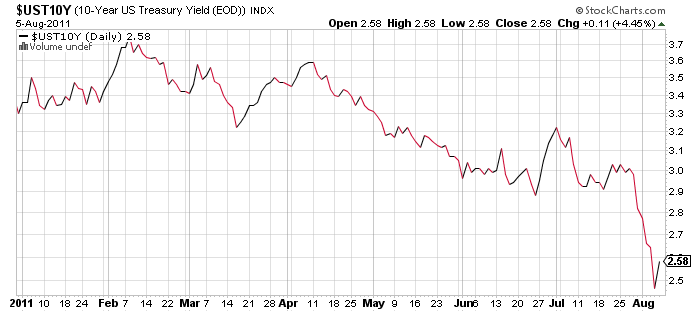

Markets in the coming week will digest the once unthinkable - the downgrade of the United States gold standard AAA rating - and the impact it will have on other credit ratings and investor confidence.

The Standard and Poor's one-notch downgrade to AA plus came late Friday, just hours after European officials managed to convince markets they were at least working towards a plan to stop Italy from being sucked down by the credit crisis. The Fed also meets Tuesday, and traders have increasingly been looking for it to restart its extraordinary easing program or take other steps, though Fed watchers doubt such a move.

"I did not expect this (downgrade) to happen this soon. This is something they gave the criteria on and I guess they stuck to it. I really thought they'd take the two stage approach and see how further (spending) cuts would come along," said George Goncalves, chief Treasury strategist for Nomura Americas.

"In the moments in the past when large countries were downgraded, our analysis shows there is some volatility. It depends on the market conditions. I don't think given the environment we're in right now, this was the optimal time to be seeing a downgrade of the largest nation in the world. The only fear I have is that after a pretty rough week in the risk markets, how is this going to be perceived by investors," he said.

What other actions or unintended consequences will follow are yet to be seen. Late Friday, the Fed and FDIC said U.S. banks will not have to increase capital due to the downgrade.

"It's very symbolic. But more importantly, we'll have to see if this will potentially trigger other rating actions, and we'll see what that means on Monday for broader markets," Goncalves said. Moody's and Fitch have both reaffirmed the AAA rating for now, though they have the U.S. on negative watch.

The downgrade also came at the end of a harrowing week for stocks. Equities markets worldwide suffered their worst declines since the financial crisis, as investors shunned risk assets and ran to the safety of cash and Treasury securities.

Marc Pado, Cantor Fitzgerald market strategist, said it may be that stocks will take the news better than some might expect because the market has been reacting to the potential downgrade by one or more notches for the past two weeks.

"Asia's going to open first, and Europe second. There might be more angst in trading there before our markets open. But after the first hour, I think we'll shake it off," he said. "If they were going to take it down more than one notch, we would have a bigger reaction of three to five percent in the market."

Whither Stocks

The stock market selling reached a crescendo Thursday when the Dow fell more than 500 points, leading some investors to wonder whether a moment of capitulation had occurred. On Friday, stocks swung volatility, with the Dow traveling more than 400 points before finishing up 60 points to 11,444.

"This is fairly typical behavior when you're getting close to a bottom. You have a dramatic move down, a lot of volatility," said Ed Keon, managing director at Prudential Financial's Quantitative Management. "..There's no guarantee this is the bottom, but these big whipsaw moves are the kind of things you see."

http://www.cnbc.com/id/44042522

| จากคุณ |

:

เกรซอยากรวย

|

| เขียนเมื่อ |

:

6 ส.ค. 54 14:52:15

|

|

|

|

|

เงินอาจจะถูกดูดกลับสู่ตราสารหนี้และทองคำมากขึ้นลดการถือตราสารทุน เนื่องด้วยภาวะเงินเฟ้อ และดอกเบี้ยที่เพิ่มสูงขึ้น

เงินอาจจะถูกดูดกลับสู่ตราสารหนี้และทองคำมากขึ้นลดการถือตราสารทุน เนื่องด้วยภาวะเงินเฟ้อ และดอกเบี้ยที่เพิ่มสูงขึ้น