|

The Commentary:

Silver rallied yesterday on news about a proposed IMF plan to aid Europe. That took equities higher, the Dollar lower and the metals up for the ride. Today that is yesterday's news as the pitiful German bond auction sent investors fleeing out of everything they bought yesterday and rushing back into the Dollar once again.

Down goes silver, crude oil, copper and just about everything else on the planet.

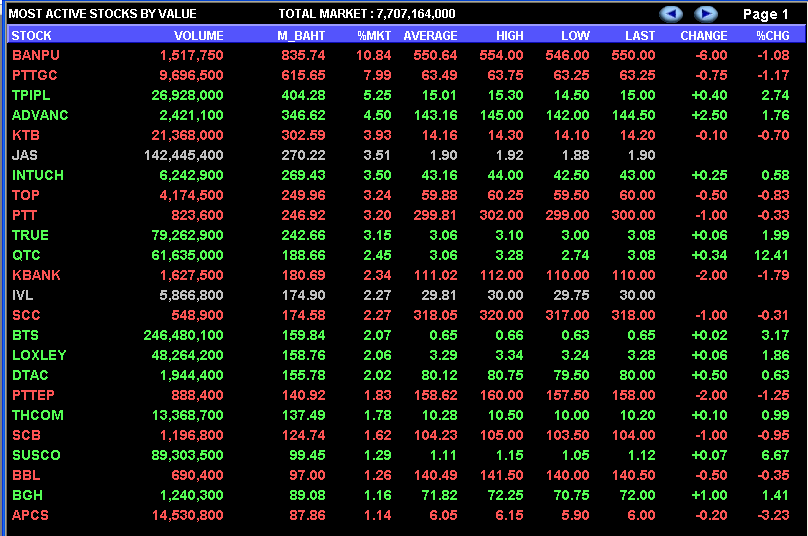

All you need to know about silver is contained in the following two charts. The first is the Continuous Commodity Index. The second is Silver. Note how eerily similar the two charts are.

This is the reason that I keep saying that silver is not going to go anywhere until the sentiment towards "RISK" and towards "INFLATION" changes. As long as traders are seeing the sovereign debt crisis in Europe as worsening and eventually causing a contraction in global economic growth, they are not going to be piling into silver as they did back during the days of the Federal Reserves' Quantitative Easing program.

Silver does however continue to find buying on dips into the region near $30 which is becoming a critical chart support level. As long as buyers see value in this area it should remain well supported as they will accumulate the metal during such bouts of price weakness. If the European contagion begins to worsen, this level could become vulnerable.

As investors rush back into the Dollar, it is poised for another trip to the 80 level on the USDX. If it manages a weekly close above this level, it is going to be rough going for the commodity complex. If it traders become convinced that even Germany is going to succumb to the contagion spreading across Europe, the Dollar is going to move through 80 like a hot knife through butter. If on the other hand a change of sentiment towards Europe emerges, 80 will prove to be a formidable resistance level. We will have to see where events lead us.

Note that both longer term moving averages, the 50 day and the 100 day, are now moving higher in conjunction - a bullish sign.

Keep in mind that even though the Dollar has its own set of problems, and that set is very significant, right now it is NOT THE EURO, and that is what has money flowing back into it.- Dan Norcini

| จากคุณ |

:

ฮะ ว่าไงนะ

|

| เขียนเมื่อ |

:

24 พ.ย. 54 07:20:59

|

|

|

|

|

..กาแฟหอมๆ และเมนูอาหารน่าทานน่าทาน

..กาแฟหอมๆ และเมนูอาหารน่าทานน่าทาน

มั่งครับ

มั่งครับ

กกกกกกกกกกกกกก กก

กกกกกกกกกกกกกก กก