|

Sun Feb 19 12 11:49 ET

Gold Weekly Technical Outlook

Comex Gold (GC)

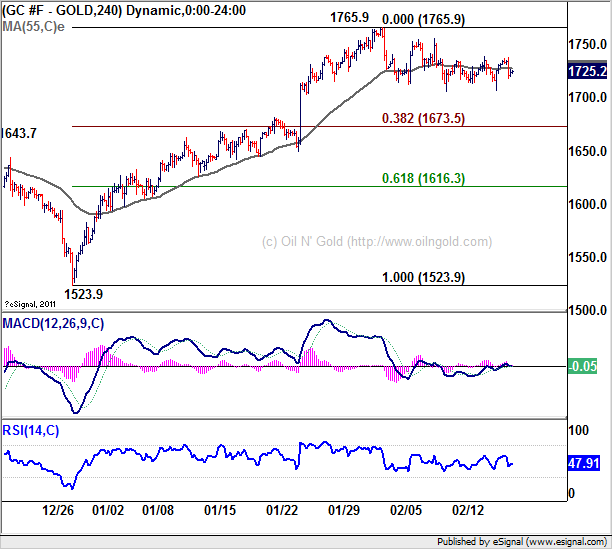

Gold is still bounded in tight range below 1765.9 last week as consolidation continued. Such consolidation will likely extend further this week and deeper retreat cannot be ruled out. Though, we'll stay cautiously bullish as long as 38.2% retracement of 1523.9 to 1765.9 at 1673.5 holds. Above 1765.9 will target 1804.4 key near term resistance next. However, sustained trading below 1673.5 will argue that rebound from 1523.9 has completed and flip bias back to the downside for this support.

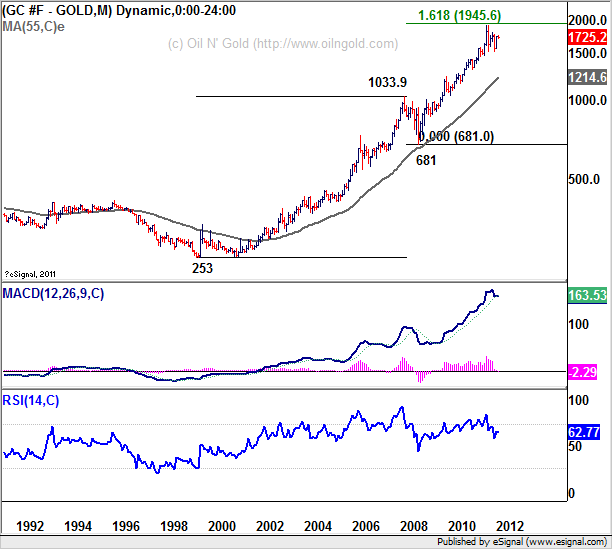

In the bigger picture, price actions form 1923.7 high are viewed as a medium term consolidation pattern. The loss of momentum ahead of 1804.4 resistance dampens the view that such consolidation is finished at 1523.9. In other words, another fall could be seen to extend the pattern from 1923.7. Nonetheless, even in that case, we'd continue to expect strong support from 1478.3/1577.4 support zone to contain downside to finish the consolidation and bring up trend resumption eventually. Meanwhile, break of 1804.4 resistance will be the first signal of long term up trend resumption.

In the long term picture, with 1478.3 support intact, there is no change in the long term bullish outlook in gold. While some more medium term consolidation cannot be ruled out, we'd anticipate an eventual break of 2000 psychological level in the long run

Comex Gold Continuous Contract 4 Hours Chart

| จากคุณ |

:

ฮะ ว่าไงนะ

|

| เขียนเมื่อ |

:

20 ก.พ. 55 15:31:37

|

|

|

|

|