คุณมาร์ผมส่งข่าวนี้มาให้ตั้งแต่เมื่อตอนบ่าย ลืมแปะครับ

*** Alert: คลังระบุในข่าวว่าอยากให้บาทอ่อนค่าไปที่ 32-34 บาทต่อดอลลาร์ ***

Thai Baht Should Weaken, Interest Rates Fall, Kittiratt Says

2012-03-22 08:10:31.769 GMT

By Daniel Ten Kate and Susan Li

March 22 (Bloomberg) -- Thailand’s government would like to

see lower interest rates and a weaker currency to help exporters

cope with higher energy costs, Finance Minister Kittiratt Na-

Ranong said.

Thai-based companies faced difficulties shipping goods when

the baht approached a level of 30 per dollar, he said in an

interview with Bloomberg Television today in Hong Kong. Exports

fell more than expected in January as factories struggled to

resume production after the worst flooding in almost 70 years

and as global demand weakened.

“Those companies have been adjusting themselves and

improved their efficiency in order to barely survive,”

Kittiratt said. “So the range of 32 to 34 would be very good.”

The Bank of Thailand yesterday joined central banks from

Australia to South Korea in keeping interest rates unchanged as

higher energy costs boosted inflation risks. Kittiratt’s

comments add to pressure for policy easing in Thailand, where

exports and manufacturing have contracted in the aftermath of

flooding last year that disrupted global supply chains.

“Thailand is similar to other countries suffering from

cost-push inflation because of higher energy costs that come out

of the tension in the Middle East,” he said. “If the central

bank would agree to let the interest rate down a little bit

further, that would be good.”

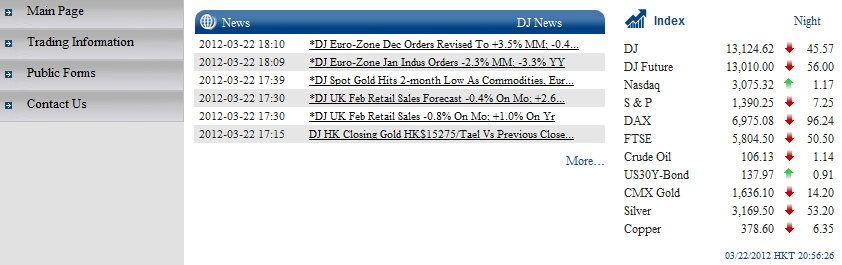

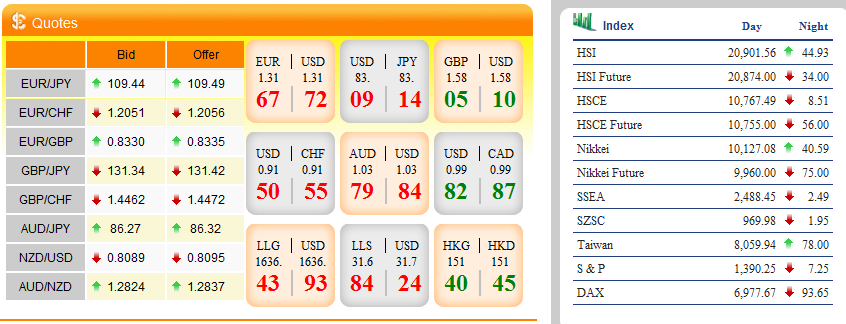

The baht declined 0.1 percent to 30.77 per dollar as of

2:44 p.m. in Bangkok, according to data compiled by Bloomberg.

It has strengthened about 2.5 percent this year, making it the

third-biggest gainer in Southeast Asia after the Malaysian

ringgit and the Singapore dollar.

“I don’t think the BOT will yield to government

pressure,” Frances Cheung, a strategist at Credit Agricole CIB

in Hong Kong, said by phone, referring to the Bank of Thailand.

“They have their own mandates and I don’t think the BOT will

just target any level for the baht. As you can see from the

BOT’s tone, they are primarily focusing on inflation and

economic activity.”

For Related News and Information:

Top economic stories: TOP ECO <GO>

Stories on Thai rice exports: NSE THAI RICE EXPORTS <GO>

Most-read stories on Thai economy: MNI THECO <GO>

Thai GDP historical data: THGDPYOY <Index> HP <GO>

Economists’ Thai interest-rate predictions: BYFC THB CB <GO>

Top Southeast Asia stories: ATOP <GO>

Central bank actions: STNI CENTRALBANKACT <GO>

--With assistance from Yumi Teso in Bangkok. Editors: Tony

Jordan, Rina Chandran

To contact the reporters on this story:

Daniel Ten Kate in Bangkok at +66-2-654-7318 or

dtenkate@bloomberg.net;

Susan Li in Hong Kong at +852-2977-6424 or

sli31@bloomberg.net

To contact the editor responsible for this story:

Stephanie Phang at +65-6499-2617 or

sphang@bloomberg.net

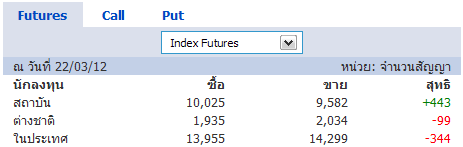

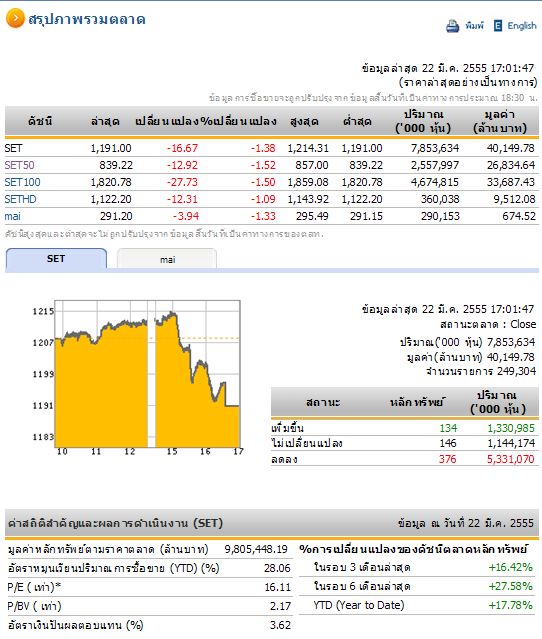

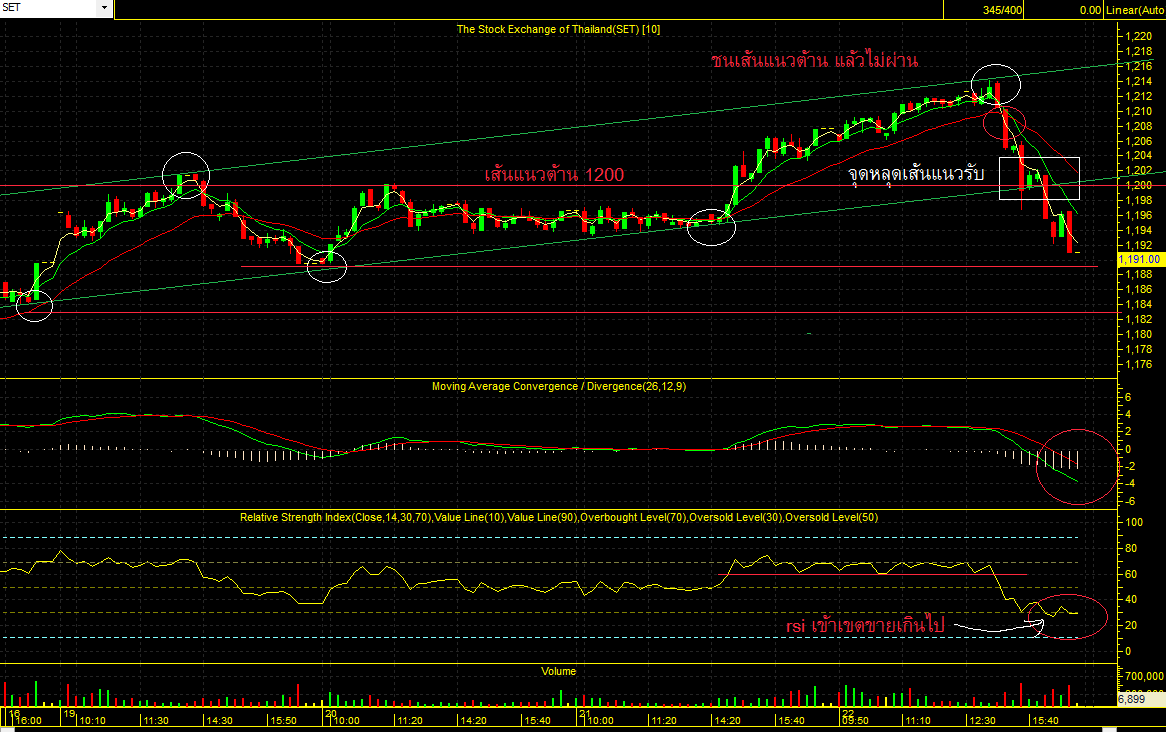

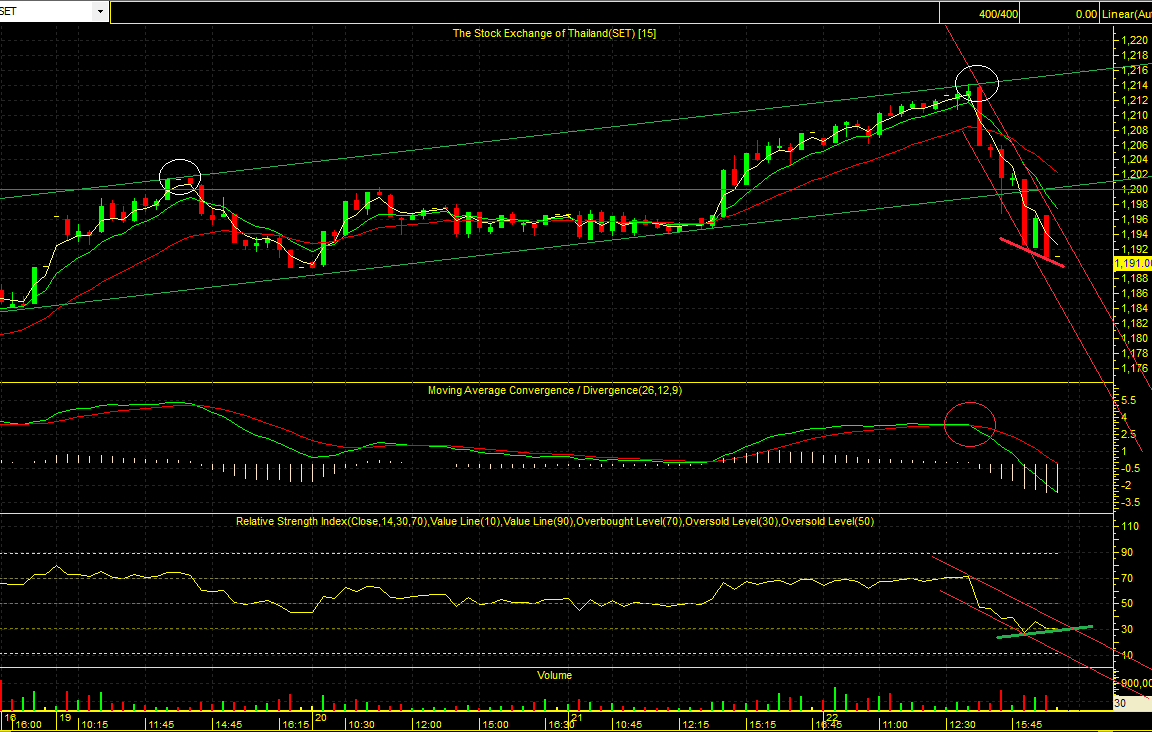

bull or bear in your sentiment หลังตลาดวาย วันพฤหัส ที่ 22 มีนาคม 2555 ครับ

bull or bear in your sentiment หลังตลาดวาย วันพฤหัส ที่ 22 มีนาคม 2555 ครับ

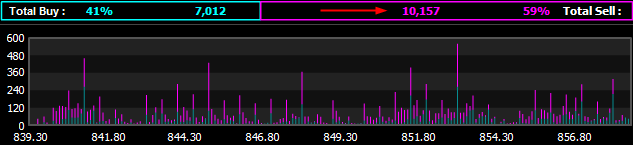

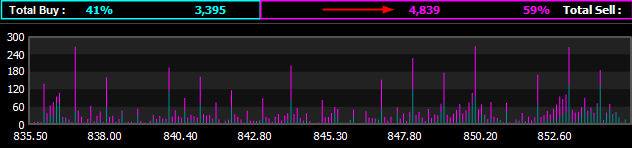

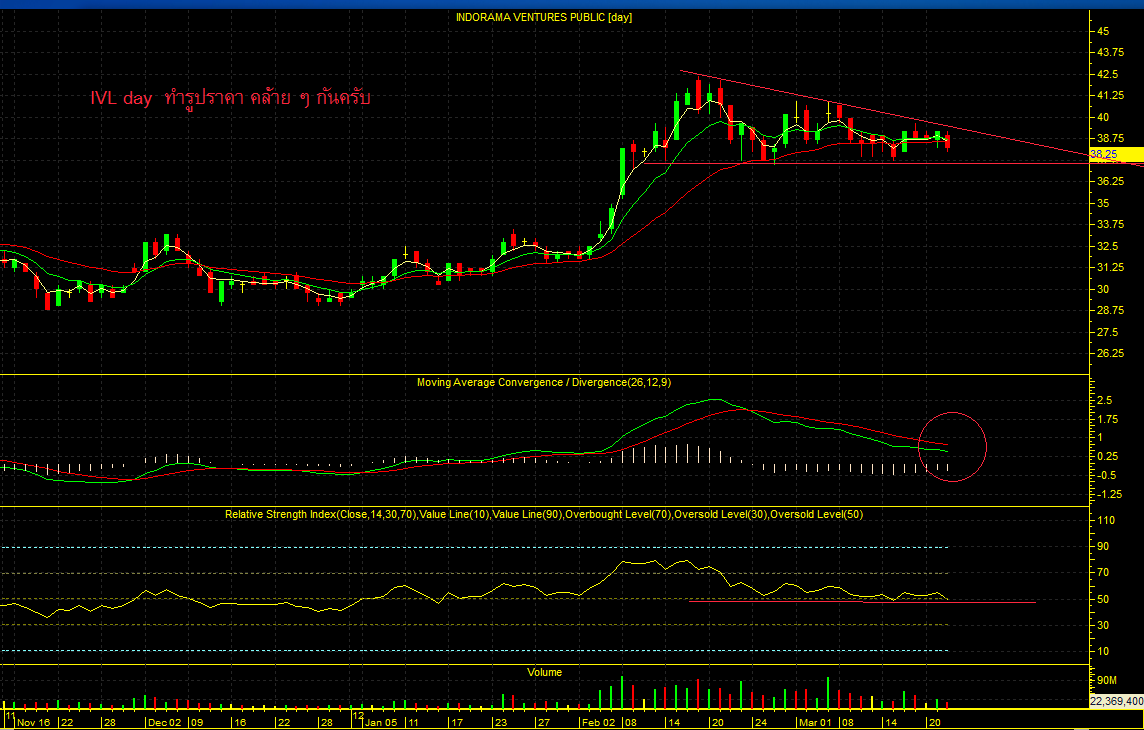

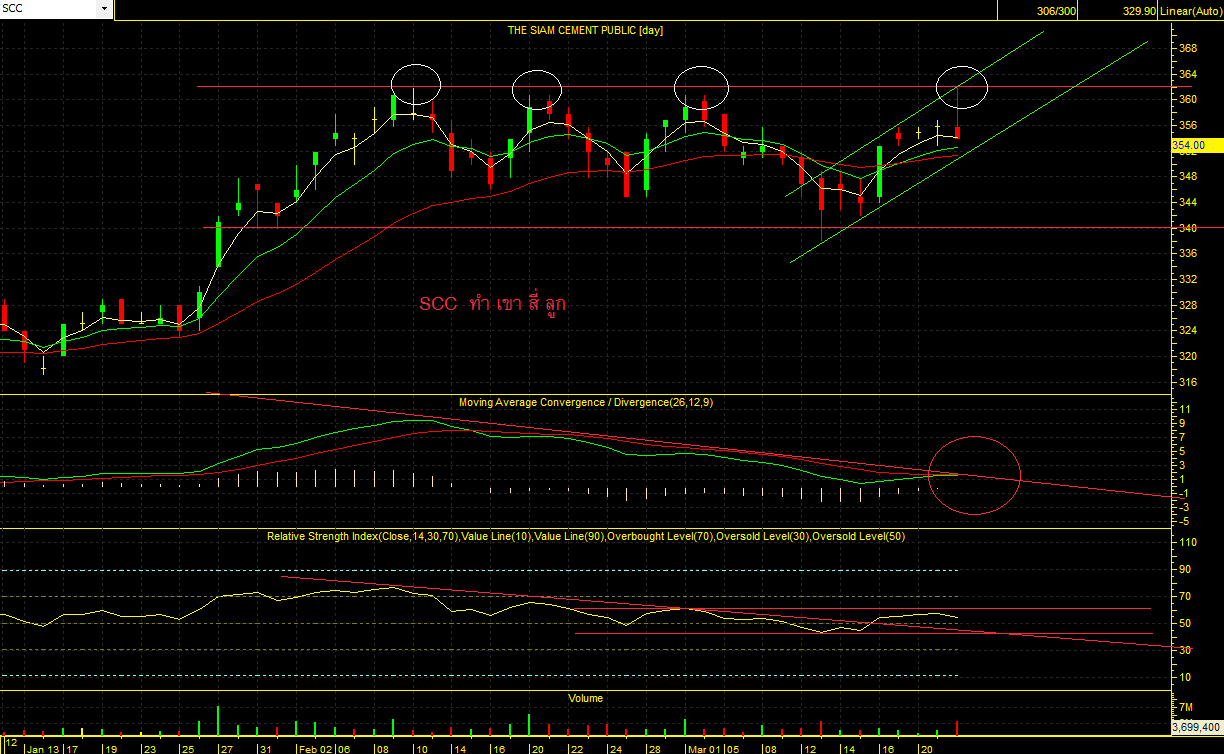

ใครจะเข้าช่วงนี้ต้องระวัง ระวังได้สลึงแต่เสียสิบ เพราะส่วนต่างแทบไม่เหลือครับ อย่างวันนี้ส่อชัดแล้วครับว่าตลาดของเรา คืออะไร ระหว่างภาพจริงหรือมายา

ใครจะเข้าช่วงนี้ต้องระวัง ระวังได้สลึงแต่เสียสิบ เพราะส่วนต่างแทบไม่เหลือครับ อย่างวันนี้ส่อชัดแล้วครับว่าตลาดของเรา คืออะไร ระหว่างภาพจริงหรือมายา

เศร้า

เศร้า

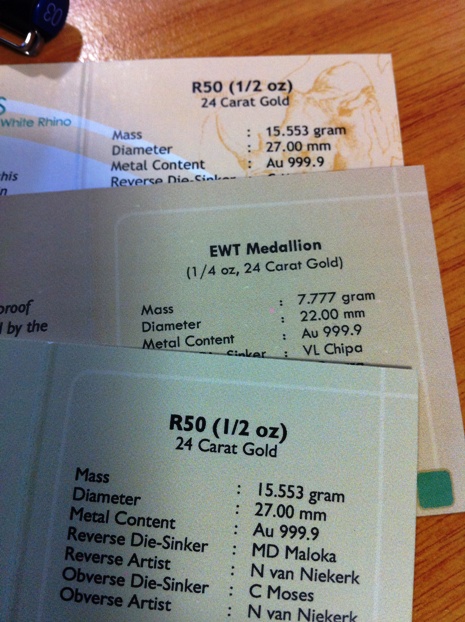

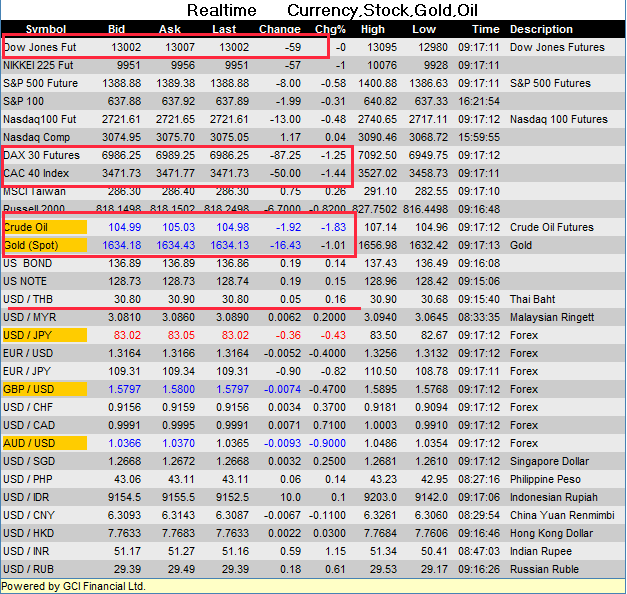

แอบไปดูเหรียญทองมาอ่ะ อยากค๊าย อยากได้ ทอง 999.9 1oz + 1/4 oz ซื้อดีมั้ยอ่ะ?

แอบไปดูเหรียญทองมาอ่ะ อยากค๊าย อยากได้ ทอง 999.9 1oz + 1/4 oz ซื้อดีมั้ยอ่ะ?