The difference between active and passive investing is like the difference between the actions of one individual vs. the actions of a group as a whole, or you can think of active investing like trying to bet on who will win the Super Bowl, while passive investing would be the ability to profit as all the NFL teams collectively made money on ticket and merchandise sales.

Let's look at an example: statistics tell us that women live longer than men. Thats a fact, and as long as we look at all women, compared to all men, it holds true. But suppose you were trying to pick out just the men who will outlive most women? Would you be willing to bet your money on your ability to choose right? An active investor or active strategy is trying to choose right.

Passive Captures the Return of an Entire Market

When you take this analogy, and apply it to investing, first you look at the entire market of available stocks. A passive investor wants to own all the stocks, because they think as a whole, over long periods of time, capitalism works, and they are likely to receive higher returns from investing in the entire stock market than by trying to pick the individual stocks which will outperform the market as a whole.

An active investor thinks they can pick out just the stocks that will have the greatest return.

Actively Managed Funds vs. Passive Funds

When you look at mutual funds, an actively managed large cap mutual fund will try to pick the best 100-200 stocks listed in the S&P 500 Index. A passive fund, or index fund, would just own all 500 stocks that are listed in the S&P 500 Index.

Active vs. Passive in Academia

Each and every year, academic studies are done comparing the returns of actively managed funds to the returns of passive funds. Each year, studies show that actively managed funds rarely have returns higher than their passive counterparts.

As a matter of fact, when you look at large cap funds, 70-80% of the time, you will have a higher return by owning an index fund than by trying to find an actively managed fund that can beat the index.

Active Management Carries Higher Costs

Part of the reason actively managed funds do not fare as well has to do with cost. It takes time to do research, and actively managed funds spend more money on overhead and staffing. In addition they have higher trading costs as they move in and out of stocks. If the index earns 10%, and the fund has 3% a year in costs, it must earn 13% just to have a net return equivalent to its index.

As passive funds do not do a lot of trading, they have lower fees, and they have less capital gains distributions that will flow through to your tax return.

Passive Investing is The Way To Go

If you want to invest in a systematic and disciplined manner, follow a passive investment strategy. If you want to speculate, pay more in fees, and more in taxes, than follow an actively managed strategy

or you could just take your money and go to Vegas.

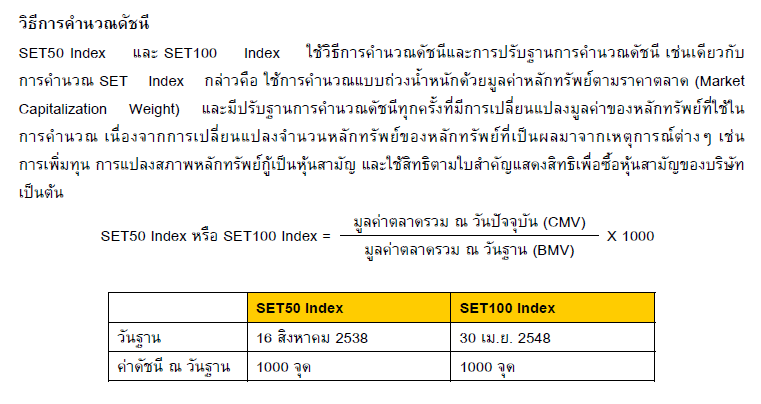

หลักเกณฑ์สำคัญในการคัดเลือกหุ้นเข้า SET50 และ SET100 ที่สำคัญ

หลักเกณฑ์สำคัญในการคัดเลือกหุ้นเข้า SET50 และ SET100 ที่สำคัญ